The everything rally continues

August 31, 2021

–Another day, another new high in equity futures. For the past three or four months, ES has had a nice break around the 19th to 20th of the calendar month, and then predictably rallies into the next month until the 14th to 16th before experiencing another pullback. Like clockwork. In September, the FOMC is on the 22nd, and Sept equity option expiration is the 17th.

–Interest rate futures continue to levitate. In the past two sessions, the blue pack (4th year forward) has rallied 9.5 to 10 bps. For example, EDU’24 settled 9866.5 and Thursday and 9876.5 yesterday. Ten year yield fell 2.8 yesterday to 1.282%. There was a buyer of around 20k TYZ 136 call for 18, settled 20 vs 133-17 with open interest rising 18k to 57k…the most open interest of any December call. A rise to 136 would target a yield around 1% on tens. Another large trade was a buy of 50k EDU’23/EDZ’23 3-month calendar for 11.5. Settled there, 9914.5 and 9903. The red Sept/Dec (one year forward, EDU’22/EDZ’22) is 15.0. December contracts have the most open interest on the ED curve out to the blues.

–Eurozone inflation hit a ten year high or 3%. In the US, Chicago PMI is released today, having been 68 last.

–I need to do a bit more work on this, but saw a report yesterday that Social Security recipients (about 20% of the population!?) can expect a bump in COLA of 5 to 6% when adjusted at the end of this year. These payments are based on CPI. I recall when cost-of-living adjustments were the big union sticking points, and were said to have contributed to the stickiness of inflation. I don’t think unions are as big of a factor any more (besides gov’t unions), but the percentage of people receiving Social Security likely dwarfs union membership at its peak, and these increases are institutionalized.

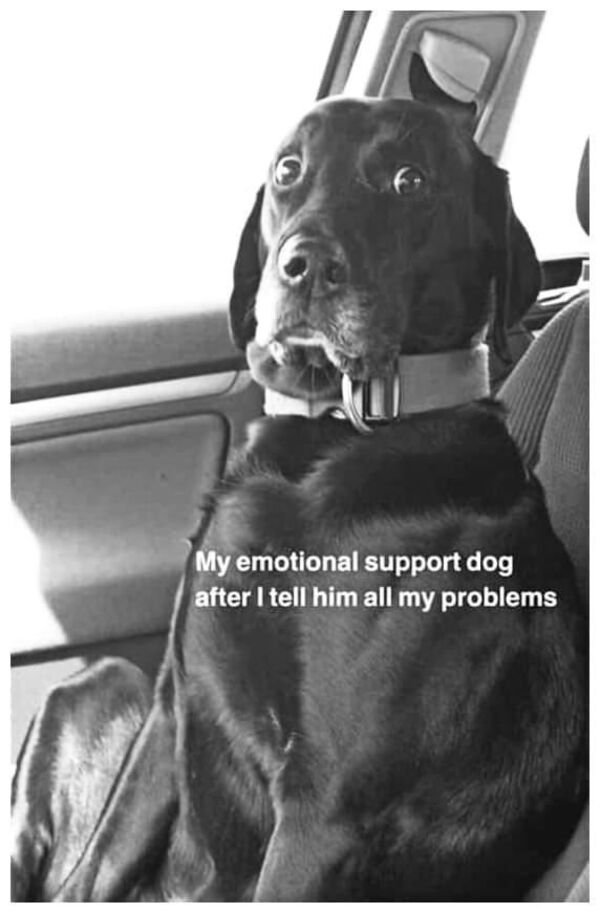

I get the same look from my dog when I say “I’ve bought more SPY puts”