Chance – Monopoly

October 3, 2021- Weekly Comment

President Xi, from September 2, “Don’t expect an easy life and be ready to struggle.”

“Central banks should try their best to avoid asset purchases because in the long run they will ‘damage market functions, monetize fiscal deficits, harm central banks’ reputation, blur the boundary of monetary policy and create moral hazard,’ People’s Bank of China Governor Yi Gang said.” (BBG 9/28/21)

Here’s John Yarmuth, Chairman of the House Budget Committee:

“This country, because we issue our own currency, and because we borrow and spend in our own currency, we can pay for whatever we want to pay for. We just tell the treasury to pay the bills, to write the checks when the bills come in…”

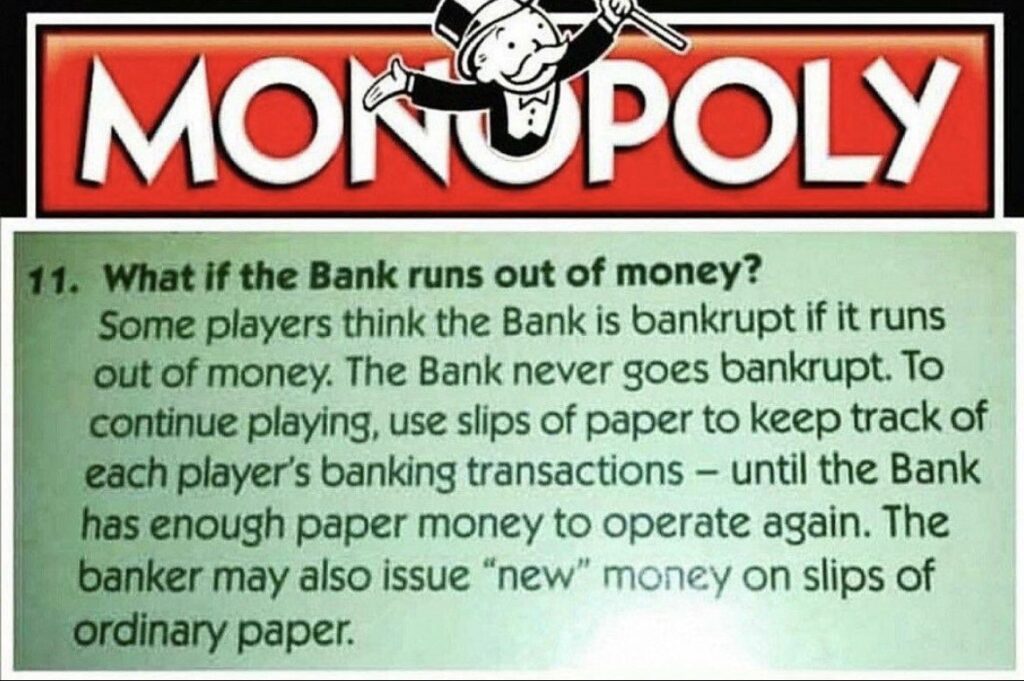

“We are not like businesses, we are not like families, we are not like state governments, we are not like local governments. We don’t have to balance our checkbook. We are like the banker in Monopoly. We create the money, we hand out the money…everybody else plays the game with it.”

Like the banker in Monopoly.

The initial part of Yarmuth’s quote is directly from Stephanie Kelton’s work on Modern Monetary Theory. Her thesis is that the federal government should not worry about “how to pay for it” but rather should make political decisions about using available resources to accomplish goals in the economy. The limitation, according to what I have seen from Kelton, is inflation. That’s when we know that resources are being stretched.

On Friday, the Fed’s preferred measure of inflation was released. PCE Deflator, 4.3% and the Core measure 3.6% yoy, both the highest in 30 years (since 1991). The PCE deflator has not had a down month since November of 2020, when it registered 1.1%. From 1.1% to 4.3% in less than a year. I would call that acceleration rather than transitory. The key point is that it’s a fly in the ointment of MMT. Resources are obviously constrained; that’s why shortages are being reported everywhere and prices are rising. That’s why China is instructing companies to secure energy supplies “at all costs”. BBG reports that ‘France Steps in to Contain Energy Prices…’ in part by cutting taxes on power. “A tariff shield.” Yet the Fed’s Summary of Economic Projections has PCE inflation at 2.2% in 2022.

There’s a fair amount of press noting that economies are not having a demand issue, but rather a supply problem. For example, consider this tweet from Frances Donald (Manulife Chief Economist): “The Fed can hike interest rates all it wants, it’s not going to make it rain in Brazil, open ports in China, find truck drivers in the UK, change covid-0 policies in Australia. Bet that the Fed will hike rates if you want, but don’t bet it will help this supply-driven inflation.”

I happen to think that the Fed, by holding rates at zero while monetizing Federal spending, has a lot to do with creating the conditions that lead to shortages. Of course there are always instances of specific shortages which are absorbed and alleviated over time, whether due to natural disasters or created by man. These are one-off events that don’t lead to an increase in the general level of prices. However, widespread shortages across the economic landscape are sparking price increases which suggest more of a root cause in monetary policy. Housing prices simply don’t go up 19% a year because people want to move.

According to the Fed’s Z.1 quarterly report, Federal Debt ended 2019 at $19.04T. As of Q2 2021 it’s $24.73T. That rise is almost matched by the increase in the Federal Reserve’s balance sheet, from $4.17T to $8.1T at the end of Q2.

Speaking of Monopoly rules, this snippet is worthy of mention in light of Fed officials’ trading:

One player is the Banker. All assets of the Bank should be separate from the Banker’s own assets. [It’s called conflict of interest]

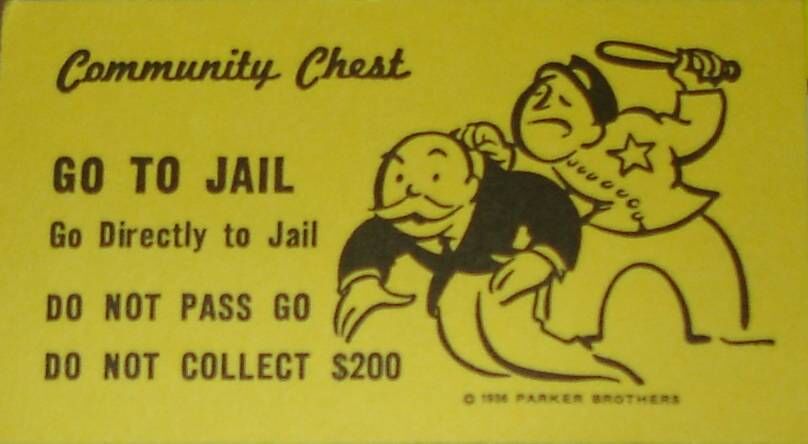

I guess that particular rule has become blurred. From Reuters: “US Federal Reserve Vice Chair Richard Clarida traded between $1 million and $5 million out of a bond fund into stock funds one day before Chair Jerome Powell issued a statement indicating potential policy action due to the worsening of the COVID-19 pandemic, BBG news reported on Friday.” I guess that was by ‘Chance’? Well, the next draw is from Community Chest:

Finally, here’s what happens when the music stops, for example for Evergrande.

The rules of Monopoly state, if you do not have enough money to pay Rent or other obligations during your turn, you may choose to sell houses, hotels, or property. Buildings may be sold to the Bank for one-half of the purchase price.

You get 50 cents on the dollar. That’s kind of like the guy that bought stock in Peloton in late January at 160, now 87. What would you rather do, take a virtual bike ride or play a good old-fashioned board game?

Here’s a final note regarding Monopoly:

In 1934, Charles B. Darrow of Germantown, Pennsylvania, presented a game called MONOPOLY to the executives of Parker Brothers. Mr. Darrow, like many other Americans, was unemployed at the time and often played this game to amuse himself and pass the time. It was the game’s exciting promise of fame and fortune that initially prompted Darrow to produce this game on his own. With help from a friend who was a printer, Darrow sold 5,000 sets of the MONOPOLY game to a Philadelphia department store. As the demand for the game grew, Darrow could not keep up with the orders and arranged for Parker Brothers to take over the game.

It was a depression-era game. The cards COMMUNITY CHEST and CHANCE are said to refer to Atlantic City: the Community Chest was a welfare organization and Chance was related to gambling.

OTHER MARKET THOUGHTS/ TRADES

The Clarida news is probably the last straw in terms of Powell’s re-nomination. I’m sure Pelosi (notwithstanding her husband’s timely investments) will be appropriately horrified by personal trading of public officials directly associated with monetary policy and jump on the Warren “Powell is a dangerous man” wagon train. Wait a second, that last sentence is quite awkward. I didn’t really mean that Pelosi engages in trading of public officials. On the other hand… you know what I mean.

We’re on the cusp of a potentially big change in Federal Reserve composition. The risk is that the new Fed will be more likely to cave in to political pressure.

More immediately, we have the all-important employment report on Friday, about which Powell said he didn’t need a “blockbuster” report for taper conditions to be met. The expectation is for NFP to be 400-500k. A concern is that the St Louis Fed put out a paper suggesting the possibility of a negative NFP print. Perhaps that’s part of the reason that yields, apart from the long end, eased by a few bps on the week. If NFP were to print negative, it would likely throw taper into question. The knee-jerk would be a rally in all treasuries, but I would expect the rally to be transitory, and a steeper curve would result.

A couple of weeks ago I suggested buying EDH’25/EDU’25 for 10 or less. Settled 12.5 Friday. This spread is blue March to blue Sept, but I would note that the blue/gold pack spread is highly correlated to movements in 10/30 treasury spread. Blue/gold settled at a new low for the year on Sept 22 at 15.75, but has since rejected that level and is now 24.25.

| 9/24/2021 | 10/1/2021 | chg | ||

| UST 2Y | 27.2 | 26.2 | -1.0 | |

| UST 5Y | 95.5 | 93.1 | -2.4 | |

| UST 10Y | 145.8 | 146.2 | 0.4 | |

| UST 30Y | 198.5 | 203.6 | 5.1 | |

| GERM 2Y | -68.6 | -70.4 | -1.8 | |

| GERM 10Y | -22.8 | -22.4 | 0.4 | |

| JPN 30Y | 67.4 | 65.6 | -1.8 | |

| CHINA 10Y | 286.9 | 287.7 | 0.8 | |

| EURO$ Z1/Z2 | 33.5 | 29.5 | -4.0 | |

| EURO$ Z2/Z3 | 65.5 | 62.0 | -3.5 | |

| EURO$ Z3/Z4 | 41.5 | 43.5 | 2.0 | |

| EUR | 117.21 | 115.97 | -1.24 | |

| CRUDE (active) | 73.98 | 75.88 | 1.90 | |

| SPX | 4455.48 | 4357.04 | -98.44 | -2.2% |

| VIX | 17.75 | 21.15 | 3.40 | |