Forward yields dropping

April 29, 2025

***************

–Steeper curve with 2s dropping 7.7 bps to 3.685%, fully 5/8% lower than the current EFFR. Tens only down 4.6 to 4.22%; 2/10 at 53.5. The strongest SOFR contract is also the peak contract, SFRU6 now at 9698.5, just over 3%. Near SOFR one-year calendars made new lows, with U5/U6 down 8 to -104.5 (9629/9698.5) and Z5/Z6 down 4.5 (9660.5/9696.5).

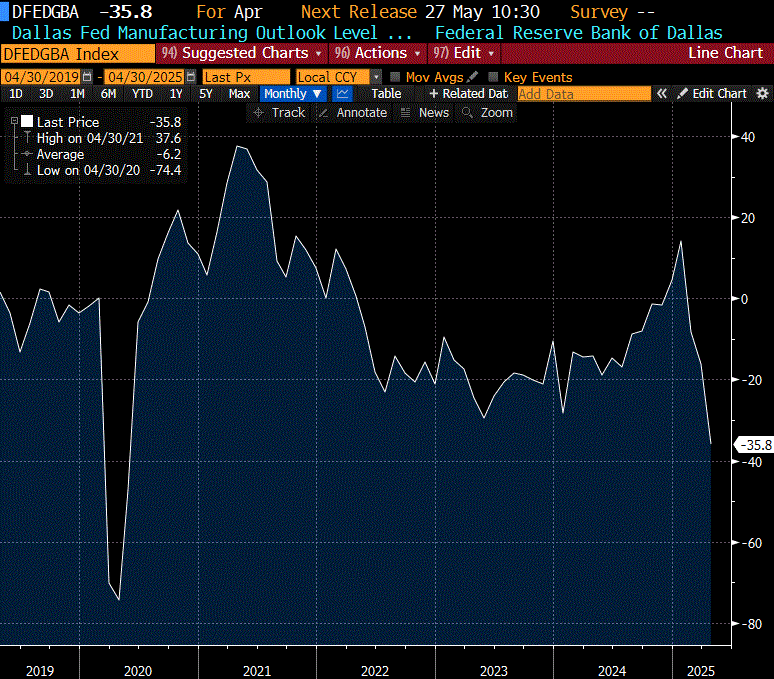

–QRA is muddled by the debt ceiling, appears to indicate lower borrowing needs by the Treasury than feared, perhaps a contributor to yesterday’s rally. Of course, Dallas Fed Mfg is yet another soft indicator which plunged to -35.8, only lower during the covid spike.

–Large trade yesterday was a roll, selling (exit) 0QU6 9750/9800cs to buy the the same in 0QZ, paying 2 to buy extra time. Did ~35k as a roll and sold extra 0QU6. Also a new buyer of 50k SFRZ5 9568.75p for 4.0 (settled 3.75 ref 9660.5).

–In the heart of earnings, with MSFT and META tomorrow and AAPL, AMZN Thursday. Today’s news includes JOLTS expected 7500k from 7568 last, Consumer Confidence expected 88.0 vs 92.9 last and Dallas Fed Services.