Anecdotal Evidence of Struggling Consumers

May 8, 2024

*************

–Quiet market Tuesday with a bias toward flatter (more inverted) curve. 2y yield essentially unchanged while the 30y fell 4 bps to 4.604% as the US Treasury auctions 10s today and 30s on Thursday. New recent low in SFRU4/U5 one-yr calendar at -88 (9489/9577). June/June is -89 (most inverted), Sept/Sept -88 and Dec/Dec -76.5. I.e. roughly 3 to 4 eases in a given year.

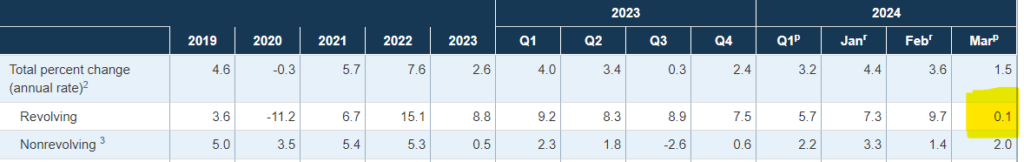

–Consumer Credit for March was much lower than expected at just $6.27B, vs $15b expected. Table below shows the dramatic plunge in revolving growth: from 9.7% in Feb to 0.1% in March.

From the report:

“Consumer credit increased at a seasonally adjusted annual rate of 3.2 percent during the first quarter. Revolving credit increased at an annual rate of 5.7 percent, while nonrevolving credit increased at an annual rate of 2.2 percent. In March, consumer credit increased at an annual rate of 1.5 percent.”

–It appears as though cracks in consumer spending are growing. As mentioned over the weekend, SBUX CEO complained about deterioration in the “occasional customer”. The stock immediately plunged 15% and edged to a new low yesterday. Disney reported yesterday. RTRS cited a drop in traditional TV and weaker box office. BBG cited “tepid outlook for growth in streaming”. Stock closed -9.5%. Does a tapped out middle-to-low end consumer represent a threat to stocks in general? Perhaps just anecdotal evidence…for now. But there’s also a chance that the administration’s “buy [votes] now, pay later” strategy peaked early.

–This is sort of a long article, but interesting with respect to Blackstone’s real estate funds (BREIT). Private fund with investors reliant on the company’s own pronouncements of NAV and investment flows.

Even as commercial real estate has been battered in the wake of the pandemic, BREIT has somehow managed to defy gravity, outperforming comparable funds by seemingly fantastic margins. In the fall of 2022, after the Fed’s interest-rate increases began to shake the commercial real-estate market, investors began asking for their money back — more than $15 billion to date…. Last year, BREIT failed to generate enough cash to cover its annual dividend.

https://www.msn.com/en-us/money/savingandinvesting/ar-BB1lXcUf