Biden, Buffett and Yellen walk into a bar…

March 19, 2023 -Weekly Comment

**************************************

Biden, Buffett and Yellen walk into a room together… Sounds like the start of good joke, doesn’t it? But apparently that’s the triumvirate at work on solving the latest banking crisis.

Elizabeth Warren wants a Congressional investigation into SVB. “We took zero % deposits and put them into 1.5% bonds and didn’t hedge. Rates made a surprise move to the upside.” There, investigation over.

In two weeks the 2y is down 100 bps to 3.83%. Discount window borrowings highest ever.

Below is a tweet from @unusual_whales

“This is truly incredible.

Here is an exchange with Senator James Lankford & Yellen:

He asks, “Will every community bank… get the same treatment as SVB?” [all deposits guaranteed]

Yellen, “Banks only get the treatment if… the failure to protect uninsured depositors would create systemic risk.”

As of early Sunday, I don’t believe Switzerland has guaranteed everything at Credit Suisse in order for UBS to “buy” CS. They will at some point. Yellen has single-handedly ensured that US too-big-to-fail banks are getting bigger, which is also a national guarantee.

What is clear is this: a deeply inverted curve eventually causes serious problems. High funding rates in a pay-as-you-go society are like gum in the engine. Now it’s all about counter-party risk. *And that’s when I showed them my gold holdings*

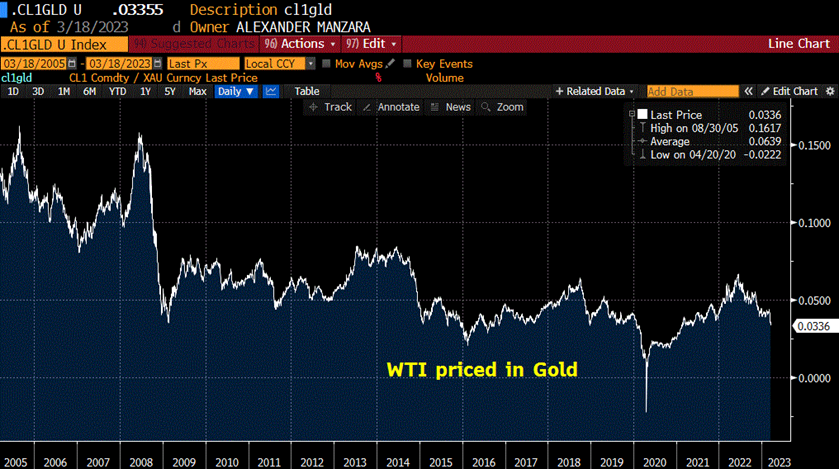

Gold soared 10% since March 7 (1814 to 1989). SPX priced in gold [chart above] made a new low for the past couple of years. WTI Crude priced in gold is near its lowest price apart from the covid theatrics in 2020, and that’s going back to the 1980s, though this chart only shows history back to 2005.

In terms of the FOMC meeting on Wednesday, FFJ3 settled 9527.0. Throughout March the Fed Effective rate (EFFR) has been either 4.57 or 4.58, a price equivalent of 9542.5. The ECB and Fed are trying to separate financial stability from inflation. NGMI.

The ECB went 50, the April FF contract forecasts a slight tilt toward the Fed doing 25 rather than nothing. After this meeting, the market predicts eases. For example, FFN3 (July, there’s an FOMC July 26, but FFN3 mostly prices the June 14 FOMC) settled 9551.5 or 4.485%, lower than current EFFR. FFN3 was up 31 bps on the day in price, and 78.5 on the week. SFRM3/SFRU3 3-mo calendar spread went from -16 on 3/10 (9471.5/9487.5) to -34 on Friday 3/17 (9562/9596). So, SFRU3 is now close to 4%.

What’s perhaps more interesting is the violent move in 2/10 from -109 on Mar-8 to -44 Friday. 5/30 went from -46 to +12 over the same time period. Moves like this suggest that the back end of the SOFR curve will become more positive. On the SFR curve, the nearest peak is SFRH’25 at 9697 (right around 3%). SFRH’27 is 9701, followed by M’25 at 9701.5, which is the absolute peak on the curve. Every contract in the three year period from March’25 to March’28 is between 9693 and 9701.5. I would think that every contract from SFRU’25 back will start moving significantly above zero on a calendar spread basis. When the Fed IS forced to ease, it typically does so quickly, and the back end of the curve steepens.

| 3/11/2023 | 3/17/2023 | chg | ||

| UST 2Y | 458.8 | 383.1 | -75.7 | |

| UST 5Y | 395.8 | 346.1 | -49.7 | |

| UST 10Y | 369.1 | 339.1 | -30.0 | |

| UST 30Y | 369.3 | 359.7 | -9.6 | |

| GERM 2Y | 309.7 | 238.7 | -71.0 | |

| GERM 10Y | 250.8 | 210.7 | -40.1 | |

| JPN 30Y | 138.7 | 128.7 | -10.0 | |

| CHINA 10Y | 288.1 | 286.6 | -1.5 | |

| SOFR M3/M4 | -124.5 | -109.5 | 15.0 | |

| SOFR M4/M5 | -72.0 | -24.5 | 47.5 | |

| SOFR M5/M6 | -17.0 | -1.0 | 16.0 | |

| EUR | 106.42 | 106.65 | 0.23 | |

| CRUDE (CLK3) | 76.78 | 66.93 | -9.85 | |

| SPX | 3861.59 | 3916.64 | 55.05 | 1.4% |

| VIX | 24.80 | 25.51 | 0.71 | |