BOJ ends negative yields. TYJ put position adjustment

March 19, 2024

*****************

–As had been consistently telegraphed, the BOJ ended negative rates, and YCC, and ended purchases of ETFs and REITS. Currently $/yen is near its recent high, well above 150.

–Yesterday yields rose across the board, with tens +3.6 bps to 4.338%. On the SOFR strip reds thru golds were down 3.0 to 4.5. New highs in a few of the near calendars: while SFRM4/SFRM5 remains the most inverted 1-yr calendar, it rose 1.5 to a new high of exactly -100 (9483.5/9583.5). The near 3-month calendars are all right around one-qtr pct: M4/U4 -26.5, U4/Z4 -28, Z4/H5 -25, H5/M5 -20.5. Suggests a smooth, continuous flight path of easing. Like Boeing stock.

–Crude remained bid with a late price on CLK4 82.28 (+1.70). On this particular contract, CLK4, the high last September was 84.87. The front contract high at that time was just over 95. Bitcoin is undergoing significant long liquidation.

–Of note: while all yields are around new highs for the year, the ‘real’ ten-year inflation-indexed note yield edged back up above 2% ending at 2.015%. The 5y tip is 1.95%. These are restrictive levels.

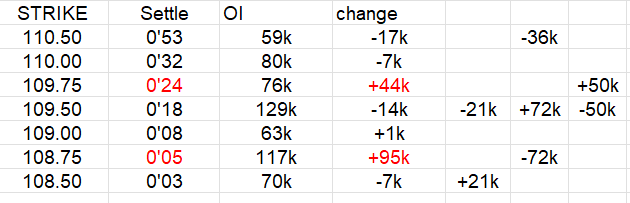

–Large position adjustment in TYJ puts as yields edged to new recent highs. On balance, it appears as if a long TYJ 110.5/109.5 ps was replaced with long 109.75/108.75p 1×2, which settled 14 (24 and 5). Summary below. April options expire Friday.

–Housing Starts and $13b 20y treasury auction today (re-opening).

TYJ 109.5/108.5ps cov 109-28, 27d, 21k at 13

TYJ 110.5/109.5/108.75p fly 1x2x2 cov 109-22, 30k, -36k at 31

TYJ 109.75/109.50ps cov 109-30, 9d 6 paid 50k