Bond Protest

June 7, 2020 – Weekly Comment

The long bond smashed a storefront window and ran away with yields this week while the authorities stood by and watched like a big city mayor. The thirty year bond yield screamed 27 bps higher to 1.676%. Tens rose 26 to 90.5. The Russell sprinted 8% on the week (new athletic shoes), with SPX lagging at just 5%, after a huge surprise in the jobs report showed an increase in NFP of 2.5 million versus an expected decline of 7.5 million.

This week is the FOMC meeting, with some expecting yield curve control, but as Mester intimated last week, that’s for the shorter end of the curve. We’ll control the things we can, like the direction of flow and checkout spacing in the grocery store. But the protesters are hand-in-hand in massive crowds. That’s what the bond market is starting to be, a protest. A protest of unfettered monetary expansion. A protest of huge deficit fueled supply (with the admin talking about another $1T support package). Maybe it will sputter out like previous attempts at higher yields. But there seems to be an uneasy turmoil below the surface.

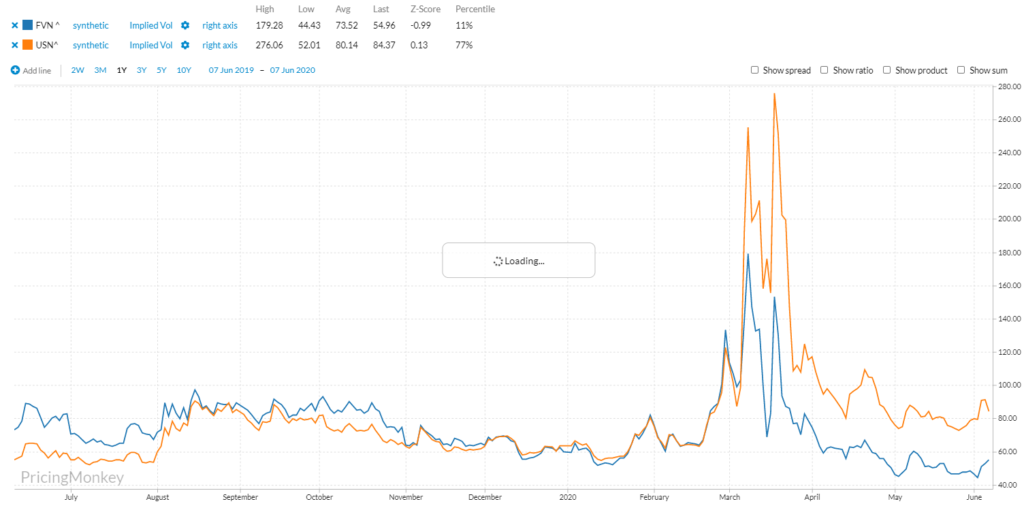

This week the Treasury auctions 3s, 10s and 30s on Monday, Tuesday and Thursday. FOMC announcement is Wednesday. According to initial TBAC estimates, the sizes are $46b, $27b and $18b against maturing amounts of $22.7, for a total of $68b raised in new cash. This, as the Fed has shaved their bond buying as of Friday to just $4b per day. The chart below (from Pricing Monkey) gives an indication of the divergence between FV (blue) and US (gold) vol. These tracked closely for eight months leading into March, then bond vol soared on a relative basis.

The St Louis Fed website indicates that the BBB option-adjusted corporate spread has collapsed from the late March high of 480 bps to 221 currently, closing in on the previous peak of 205 bps associated with the Q4 2018 stock swoon.

What might turn out to be a key issue for the Fed is Wall Street vs Main Street. Once again, the financial flows emanating from the Marriner Eccles Building seem to benefit financial engineers rather than small businesses struggling to come back from the pandemic. If Powell attempts to forcefully confront this topic at Wednesday’s press conference, it could spark a sharp pullback from last week’s stock rally.

On the euro$ curve, the red/gold pack spread closed at a new high of 62 bps, highest in three years, up 20 on the week. This is the second year vs fifth year, which correlates to 2/10 in treasuries. The 2/10 spread ended at a new high or 69, also +20 on the week, and the 5/30 treasury spread at 120, a new high but up only 9.5.

On the longer term chart, the current move doesn’t look all that dramatic. The 2012 to post-taper-tantrum 2013 surge was 200 bps. The 2007/08 crisis easing also sparked a run of around 200 bps. There is a triple top on this chart just over 300 bps, occurring in 2009, 2011 and late 2013. The last gold euro$ contract, currently EDH’24, settled exactly at 99.00 or 1%, the first time an ED contract has been at 1% or higher since late March. Keep in mind, if the red/gold spread were to reach 200, then the gold pack would have to be at least around 2.75%. As I noted during the week, on Tuesday there was a new seller of the 3rd gold, EDZ’24 in size of about 8000 at a price around 99.32. This contract settled Friday at 9905.5.

A fair amount of press has been given to the buyer of >100k EDM’21/EDM’22 spread from 6 to 7.5 bps over the past two weeks. This one-year calendar settled 12.0 on Friday, a nice winner. It’s somewhat instructive to compare this spread level to the one-year calendars further back. In the two week period from May 22 to Friday, EDM’21/M’22 rose 7 bps, EDM’22/M’23 rose 7.5 and EDM’23/M’24 rose 6.0. The spread settlements on Friday were 12.0, 22.0 and 23.0. The more deferred spreads are nearly twice as high as M’21/M’22, indicating that a move towards monetary policy ‘normalcy’ is perceived to be around three years away.

I can’t help but mention that Illinois (Wirepoints.org) has become the first state to borrow from the Fed’s Municipal Liquidity Facility, $1.2b at a rate of 3.82%. The first state borrower from the “lender of last resort”. As S&P Global Ratings said, Illinois’ budget “continues to be precariously balanced, and does not include measures to meaningfully address structural instability.” Shake Shack famously returned money to the Treasury after Mnuchin admonished large firms to tap the markets if they had access, rather than the government. Nothing more to see here.

Last note concerns a tweet by @Puff Dragon11: “Even more rare is that this one coming up on June 21st [the annular solar eclipse] is ALSO flanked by a lunar eclipse on June 5th and July 5th – 3 eclipse events all within a single ‘lunar month’. This has NEVER happened in the last 2000 years.”

A ‘strawberry moon’ eclipse followed by a ‘ring of fire’ solar eclipse followed by a ‘thunder moon’ eclipse. So we’ve got that going on for us. Which is nice.

OTHER MARKET/TRADE THOUGHTS

June midcurves expire Friday. 0EM 9975^ settled 3.5 vs 9974.5 in EDM1. 2EM 9962.5^ settled 5.5 vs 9962.5 in EDM2 and 3EM 9937.5^ settled 9.5 vs 9940.5 in EDM3. Once again, the blue straddle at nearly 3x the nominal value of the red indicates uncertainty on the back end of the curve.

Germany/Italy ten-year spread ended the week at 169 in the wake of extended and growing stimulus from the ECB, a fairly steady decline since the April 21 high of 263. Worth exploring a renewed widening of this spread, with good support around 158/160.

| 5/29/2020 | 6/5/2020 | chg | ||

| UST 2Y | 15.6 | 21.4 | 5.8 | |

| UST 5Y | 30.0 | 47.4 | 17.4 | |

| UST 10Y | 64.4 | 90.5 | 26.1 | w/I 90.7 |

| UST 30Y | 140.5 | 167.6 | 27.1 | w/I 168 |

| GERM 2Y | -65.9 | -60.1 | 5.8 | |

| GERM 10Y | -44.7 | -27.7 | 17.0 | |

| JPN 30Y | 50.3 | 56.2 | 5.9 | |

| EURO$ U0/U1 | -9.0 | -3.0 | 6.0 | |

| EURO$ U1/U2 | 8.0 | 15.0 | 7.0 | |

| EUR | 111.04 | 112.90 | 1.86 | |

| CRUDE (active) | 35.49 | 39.55 | 4.06 | |

| SPX | 3044.31 | 3193.93 | 149.62 | 4.9% |

| VIX | 27.51 | 24.52 | -2.99 | |