Fed HODL

March 27, 2024

*****************

–Yields down slightly in a quiet session. Tens -1.7 bps to 4.234%. Implied vol continues to compress in front of the long weekend. Good 5yr auction. Capital Goods Orders non-defense solid at +0.7. However, consumer confidence slipped to 104.7, lower than 107 expected (middle of the 2023 range, so no big deal).

–Buyer of 20k SFRQ4 9487.5/9475/9462.5p tree at 1.25 and slightly higher synthetic. Settled 1.25 ref 9517.0 in SFRU4 (4.0/1.75/1.0). The July version settled 1.0 (3.0/1.25/0.75). The June version is 3.75 (6.5/2.25/0.50), and that’s with SFRM4 settling close to the upper strike at 9488.5. Looking for a Fed on hold; see Waller below.

–7 year auction today.

–Waller speaks at Econ Club of NY tonight at 6:00pm. His speech on Feb 22 was titled “What’s the Rush?” [to ease]. One line: “I am going to need to see at least another couple more months of inflation data before I can judge whether January was a speed bump or pothole.” In terms of El-Erian’s assessment that the Fed is shifting to a target range on inflation somewhat higher than 2%, we’ll see if Waller modifies his stance from the Feb 22 speech. This doesn’t sound like a guy abandoning the 2% target:

…we could take our time and collect more data to ensure that inflation was on a sustainable 2 percent path.

This means waiting longer before I have enough confidence that beginning to cut rates will keep us on a path to 2 percent inflation.

More data, and more time, will tell whether January’s CPI report was just a bump in the road to 2 percent inflation.

…continued progress toward the Federal Open Market Committee’s (FOMC) 2 percent inflation goal.

…I still consider them to be somewhat elevated to achieve our 2 percent goal.

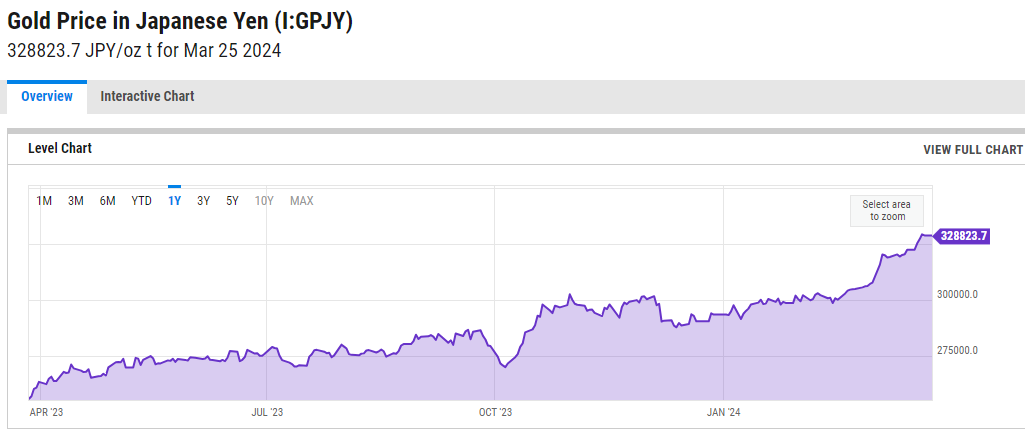

–BOJ’s recent rate hike did little to stem the slide in the yen. Today there are official warnings of intervention with $/yen above 151. A year ago gold priced in yen was 255961. Now it’s 328823, up 28%.

From ycharts.com