Interest rate anguish (with tens at 3%)

May 4, 2022

–New low settles in EDU2, Z2, H3, M3 (9720, 9671, 9646 and 9631.5) in front of the FOMC and futures are a couple lower this morning. Relentless. At the futures settle, 2s were at a new high yield of 2.768, up 3.5), 5s at 3.003 and tens at 2.956%. As a friend pointed out, July Fed Funds settled 9851.5 or 1.485%. Current Fed effective is 33 bps. The difference is 115.5. The July FOMC is on the 27th, so whatever happens at that meeting is worth 13%, i.e. a hike of 25 causes a price decline of 3.25 and a hike of 50, 6.5. Therefore, if the market was exactly pricing three 50 bp hikes in a row, FFN2 would be 33+106.5 or 139.5, a price of 9860.5. Obviously, a bit more is embedded.

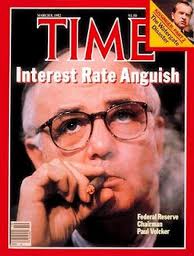

–EDM3 is still the lowest contract on the strip at 9631.5, but looking at the chart, there doesn’t seem to be any reason it couldn’t go to 9600. EDM2/EDU2 settled at another new high of 89.5, rising 4.5 on the day! Powell’s going to show up at the press conference in a rumpled suit, smoking a stogie and wearing one of those canvas fishing hats with a couple of lures pinned to it just to drive home the Volcker-esque message. (Except Volcker wouldn’t talk about it, he’d just raise rates).

–In front of today’s FOMC, there was selling of eurodollar straddles, notably EDZ2 9675^ which settled 90 from 93. EDU2 9725^ settled 58 from 62. These are still high levels, and as Nova Satus mentioned, if the Fed hikes 50 three times in a row, the range of possibilities for the rest of the year narrows.

–Of course, if stocks continue their descent, then my guess is that three 50s in a row will be in question. Powell may think he’s Volcker, and certainly he handled the pressure from Trump rather gracefully, but if stock fortunes crumble the pressure will be magnitudes of Trump’s harping during the 2018 cycle.

–Trade, ISM Services and ADP (expected 400k) this morning.