Canary

March 16, 2025 -Weekly Comment

*************************************

The inset is a painting ‘The Goldfinch’ by Carel Fabritius in 1654. It features in the 2013 Donna Tartt Pulitzer Prize winning novel of the same name. In the book, the young protagonist Theo Decker is at New York’s Metropolitan Museum of Art with his mother when a bomb explodes. His mother is killed. In the rubble he takes the painting. Throughout his youth to early adulthood, he conceals the artwork, but it is stolen from him by a friend involved with nefarious associates. From a summary, “…the painting has since been used as collateral by criminals and drug dealers.”

It’s not a canary. But for the purposes of this note, it might as well be.

An article in the Financial Times last week reports that lenders are issuing margin calls to borrowers who have used fine art as collateral for loans, as the value of art has declined. The article estimates the total amount of the market at around $40 billion, secured by art worth perhaps double that. Collectors sometimes borrow to create liquidity. Obviously, this is a tiny sliver of global markets. However, the same dynamics run through the world’s financial system. It gives some degree of pause when Bessent talks about monetizing the Federal Gov’t balance sheet…

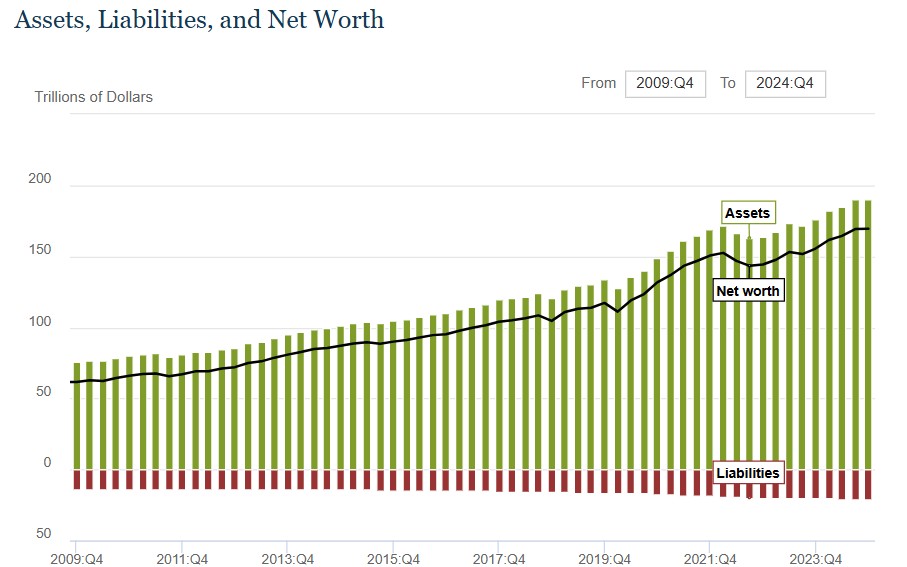

When one looks at total Household Sector net worth (published by the Fed last week, quarterly report, chart below) it reveals current NW of $169T: Assets 190t and liabilities 20.8t. Staggering growth since Q1 2020, when Assets were 128t, Liabilities $16.6t and NW $111t. Net worth has exploded by about 45% in nearly 5 years, in the amount of $58t. I listened to a recent Thoughtful Money podcast with Cem Karsan, and he refers to this increase as an increase in ‘collateral’. But the numbers don’t really bear that out. Household liabilities aren’t increasing anywhere near the same rate. Except for one borrower of course. Uncle Sam.

The same Z.1 Fed report shows Federal Gov’t Debt at $19.5t in Q1 2020 vs $31.6t in Q4 2024, an increase of 62%. Maybe that’s a fabulous multiplier. Increase Fed’l debt by $12.1t to get over 4x that in HH net worth. (Total Business debt from $18.69t to $21.55, up 15%).

Of course, it comes at a price when one steals from or borrows against the future. Five years from the depth of covid is a good time to reflect. For example, the Fed’s five-year policy review will be released in August. Last time it resulted in the ill-fated FAIT (Flexible Avg Inflation Targeting).

In March of 2020 the five-year note yield was at the then historic low of around 40 bps. By August it had reached the all-time low of 19 bps, right at the time of FAIT. The all-time low in tens, also in August, was 51 bps. We’re right around the five-year anniversary. So, if a corporate had ‘termed-out’ all debt at the 40 bp low in March 2020, it’s now running about 3.75% higher. Obviously, corporate finance is a dynamic process, and everyone knows rates soared. The point is that it can take a fairly long period for pressures to build. Of course, changes can also be rapid, as evidenced by last week’s plunge in Consumer Sentiment which printed 57.9, lowest since late 2022 and down from 74 at year’s end. (Conference Board’s Consumer Confidence data reflects a similar drop). One brief note, in late 2022 when confidence measures were floundering as the Fed hiked, stocks were selling off. SPX ultimately bottomed at 3491, which was a 50% retracement of the covid low of 2192 to the start of 2022 high at 4819. If SPX had a similar 50% pullback from the 2022 low to this year’s high, it would be 4813 (current 5639).

Retail Sales are released Monday. Many anecdotal reports (WSJ article, ‘Consumers and Businesses Send Distress Signal as Econ Fear Sets In’) support the idea of lessened confidence. Retail shares have been hammered. XRT (the retailer ETF) is off 17.3% since the end of January. We’ll see if Retail Sales data can hold.

The big event of the week is the FOMC press conference on Wednesday. No change in rates is expected, but I think Powell will set the stage for a May 7 cut. As I mentioned last week, the Fed has subtly indicated that the labor mandate is now more important than inflation. While the U of Mich Inflation expectations data soared in last week’s release (1y was 4.3 last and expected, actual 4.9%) the 5 and 10 year breakevens are at the lows for this calendar year. 5y is 2.53% and 10y is 2.31%. The next PCE price data is 28-March. Also likely is some discussion (announcement?) regarding the end of QT.

I enjoyed reading The Goldfinch, though some critics panned it. Everything turned out in the end. It will this time too. Eventually.

OTHER THOUGHTS, TRADES

Implied vol was pressured in treasuries, especially near the end of the week. MOVE index went from 104.41 to 101.01. On Friday, March 7, TYM5 settled 110-185 and TYM 110.5^ settled 2’39. On Friday, TYM5 settled 110-205 and TYM 110.5^ settled 2’29.

On Wednesday, BBG reported that ‘Brevan Howard Slashes Trader’s Risk-Taking as Losses Exceed 5%’. I have to believe that some large positions have been recently jettisoned across markets. For example, the pop in TY following lower than expected CPI was immediately rejected. On the week, treasury yields showed little net change (table below), even as gold posted a new all-time high, ending the week at 2985 (GCJ5 3301.10s).

The lowest quarterly SOFR contract is SFRM5, now the first quarterly slot, which settled 9593.0 from 9596.5 the previous Friday. The peak contract is SFRU6 at 9641.5, down just 1 bp on the week. Near contracts were sold on higher than expected inflation expectations, but again, net changes were small.

I believe Powell will signal a May cut (dependent on inflation data). The meeting is May 7. By early June I think another cut will be priced with near certainty for the June 18 FOMC.

| 3/7/2025 | 3/14/2025 | chg | ||

| UST 2Y | 400.0 | 401.7 | 1.7 | |

| UST 5Y | 409.4 | 408.4 | -1.0 | |

| UST 10Y | 432.2 | 431.0 | -1.2 | |

| UST 30Y | 461.7 | 461.5 | -0.2 | |

| GERM 2Y | 224.7 | 218.7 | -6.0 | |

| GERM 10Y | 283.6 | 287.4 | 3.8 | |

| JPN 20Y | 223.1 | 226.4 | 3.3 | |

| CHINA 10Y | 184.5 | 185.1 | 0.6 | |

| SOFR M5/M6 | -46.5 | -47.5 | -1.0 | |

| SOFR M6/M7 | 9.5 | 4.0 | -5.5 | |

| SOFR M7/M8 | 12.5 | 12.5 | 0.0 | |

| EUR | 108.34 | 108.79 | 0.45 | |

| CRUDE (CLK5) | 66.75 | 66.91 | 0.16 | |

| SPX | 5770.20 | 5638.94 | -131.26 | -2.3% |

| VIX | 23.37 | 21.77 | -1.60 | |

| MOVE | 104.41 | 101.01 | -3.40 | |

https://x.com/ftfinancenews/status/1900600512602398825

Collectors reluctant to sell at low prices used art-backed loans as “a way to create liquidity out of something that’s just sitting there”, said Nishi Somaiya, global head of private banking, lending and deposits at Goldman Sachs.

When credit turns

March 14, 2025

****************

–New all-time high in gold yesterday and this morning GCJ5 is up over $17/oz just above 3008. GCJ5 settled 2991.30, +44.50. This, despite Schumer’s reversal, which for now, averts the chances of a government shutdown.

–Yields fell yesterday as equities continued to decline (SPX -1.4%). Tens down 3.4 bps to 4.276%. Ten-yr has been holding right around the Fed Effective rate of 4.33%. The 2y fell 4.6 bps to 3.95%. Ten year breakeven notched a slight new low at 231 bps. Today, U of Mich releases inflation expectations with 1-yr at 4.3%, same as last, and 5-10yr expected 3.4% from 3.5% last.

–Not much to report with respect to SOFR contracts. SFRZ4 to SFRZ8 rose 4 to 5.5 bps. All contracts in the two years from Z5 to Z7 are between 9636 (Z5) and 9649.5 (U6), consistent with a forward FF range of 3.5 to 3.75%. Current is 4.25 to 4.5%. March SOFR options expire today.

–Fed’s Z.1 report showed Household net worth rose $164 billion in Q4. In Q3 it was up $4.8 trillion! Q1 not looking good…

–A couple of weeks ago I noted some decent size open interest in puts on HYG, a high-yield etf. From the chart below, probably would have been better on JNK as that has broken down more decisively. One of the ‘financial conditions’ parameters reviewed by the Fed is credit spreads. While still low, these spreads have perked up a bit. It seems to me that the growth in private credit came after the regional bank meltdown in 2023. Silicon Valley Bank failed almost exactly two years ago. I don’t know a lot about the regional banking crisis, but I wouldn’t characterize the problem as bad loans, but perhaps loans provided too cheaply, as if the low rate regime would last forever. Depositors pulled funding like a rug, and it was game-over. Private credit and equity investing is supposedly a way to juice returns, but in this case I don’t think the funding can easily be pulled, nor do I think it’s appropriately marked-to-market. It can, however, completely dry up. Slower deterioration.

Weaker than expected CPI provides no comfort for bonds

March 13, 2025

****************

–CPI was a little better than expected with monthly readings of 0.2 both headline and Core. Headline yoy was 2.8 vs expected 3.0 and 3.1 on Core vs 3.2. PPI today.

–However, bonds traded weaker on the day, partially due to continued supply. Ten year auction went well with a yield of 4.31%. Overall yields ended higher with tens up 2.4 bps and 30s up 2.6 at 4.626%. 30 year auction size today is $22b.

–Front end was weakest part of the market with 2y +5.8 to 3.995%. On the SOFR strip SFRZ5, H6 and M6 were all -7 at 9632, 9640.5 and 9644.0. With just a week to go until FOMC, March is priced for steady policy. while the May 7 meeting is priced at odds of about 36% for a 25 bp cut (FFK5 settled 9573). They’re going to cut at the May meeting in my opinion.

–Stocks a bit lower as of this writing as Schumer closed the door on a continuing resolution to keep the gov’t open. Budget deficit released yesterday was $307 billion for month of February and record $1.15 trillion for the first 5 months of the fiscal year. A $300 billion/month deficit at 4% adds $1 billion per month to the interest rate bill. April Gold is 2956 this morning, up 9.2 and threatening last month’s highs. Retailers continue to trade poorly, after making new highs in Feb, WMT is down 19%, COST is down 14% and TGT, which has been in a prolonged slide is 24% off the high made in Feb.

–Implied vol hammered in rate futures as CPI provided little drama. As an example, TYJ 111^ settled 1’12 Tuesday, with TYM 111^ at 2’44. Yesterday: TYJ 110.75^ 0’59 and TYM 110.5^ 2’33.

SFRH5 opts rolling off Friday. Where will SFRM5 be on 13-June opt expiration

March 12, 2025

****************

–Despite equity market volatility yields rose yesterday with tens up 7.5 bps to 4.286%. Today brings CPI and 10-yr auction of $39b. CPI expected 0.3 headline and Core with yoy 2.9 (from 3.0) and Core 3.2 (3.3). In February, the ten-yr breakeven (10y yld minus inflation-indexed 10y) hit a high of 247 bps. Now it’s 232. The low in 2024 came close to the Fed’s target at 203. My guess is that it will settle in around 220-225. The US market does not fear inflation. Even if crude oil bounces back near 70, it will be below year-ago levels.

–Ten-yr German bund yield is 2.90 this morning, closing in on the high-water mark of 2.97 in 2023. Since November the bund yield has surged nearly 90 bps.

–(Fortune) Goldman’s GDP projection for 2025 now sits at 1.7%, down from 2.4% at the start of the year. [below consensus]

“Instead, the reason for the downgrade is that our trade policy assumptions have become considerably more adverse, and the administration is managing expectations towards tariff-induced near-term economic weakness,” [Jan Hatzius] wrote Tuesday in a note to clients.

–March quarterly SOFR and midcurves expire Friday. SFRH5 settled 9571 yesterday or 4.29% against EFFR of 4.33%. SFRH6 settled 9647.5 for a spread of -76.5. With March rolling off, it’s worth looking at where M5 will ultimately settle.

–My base case is that the Fed cuts 25 at both the May and June meetings. SFRM5 options settle 13-June, FOMC is 18-June. The advance GDP report for Q1 comes out April 30, and it’s likely to be negative. Data probably isn’t capturing the extent of government cuts. Current EFFR is 4.33 and SOFRRATE is 4.33 to 4.37. A cut of 50 by June is 3.83 in EFFR. Next meeting is July 30, and will likely price some odds of another ease. SFRM5 settled 9599 yesterday. My peg for final settle is 9620 to 9623 (3.80 to 3.77). This is NOT a recommendation, but SFRM5 9600/9625/9643.75 broken call fly settled 3.5. Even if the contract were to settle above the top strike, fly would settle 6.25. so there would be a little profit.

All about stocks

March 11, 2025

****************

–SPX fell 2.7% and Nasdaq Comp fell 4.0%. Decline from the highs is of greater magnitude than seen last August (yen-carry scare). Signs of a short-term bounce this morning.

–FFN5 settled 9600.5 (+6.0 on the day) or just under 4% vs current EFFR of 4.33%. FOMCs next week (nothing expected) then May 7 and June 18. Possible eases at both meetings? The Fed has signaled a bias toward labor conditions rather than inflation; today JOLTS is released, expected 7600k from 7600k last. Low last year was 7372. Auctions of 3s, 10s and 30s kick off today with the three-yr.

–Ten-yr yield sank 10.4 bps yesterday to 4.211%. Two-yr yield fell 10.6 to 3.894%. However, the 30y yield fell only 7.7; new recent high in 5/30 spread at 56.6, up 4.5 on the day. Near SOFR calendars made new lows of course, with SFRH5/H6 at -81.5 (9572, +1.5 & 9653.5, +13.5). Like FFN5, SFRM5 is just under 4% at 9603.0. Strongest contract on the SOFR strip is also the peak, SFRM6 at 9657, up 14. Buyer of 40k 0QM5 9750/9800cs for 2.75, settled 3.0.

–Unsurprisingly, rate vol jumped. The seller Friday of 50k SFRU5 9625c at 24 covered 9625.5 to 9626 (straddle = 47.5 to 47) was just a little early; SFRU5 9625^ settled 49.5. I marked TYJ5 111.25^ at 1’15s or 8.0 and TYM5 111.0^ at 2’47 or 6.8. New highs. However, by way of comparison, BBG one-month vol shows a high of 7.8 in one-month vol on August 5 (yen-carry), and 7.2 now. VIX around 27.

–CPI tomorrow expected 0.3 headline and core. YOY 2.9 and 3.2 Core.

Stocks start the week weak

March 10, 2025

******************

–Friday’s payroll data was about as expected with NFP 151k and the Unemployment rate up 1/10th to 4.1%. However, U-6 jumped 0.5 to 8.0%. Then year yield rose 2.9 bps to 4.315%.

–JOLTS tomorrow expected 7665k from 7600k last. The high in 2022 which preceded peak CPI of 9.1 by a few months was 12182k, low last year 7372k. FOMC is a week from Wednesday, so thankfully we’re in the blackout period. However, President Trump does, on occasion, make an unexpected comment that throws the market for a loop.

–US auctions 3s, 10s and 30s starting tomorrow. As of now, equity market weakness seems to be supporting fixed income. As of this writing on Monday morning, ESH is -66 at 5710.

–Truflation index down to 1.4%. Perhaps there’s an ‘overshoot/undershoot’ aspect to the data, but the high in June of 2022 was 11.6%. This as we await CPI on Wednesday, expected 0.3, with yoy 2.9 (from 3.0) and Core 3.2 (from 3.3).

–Large trade Friday appears to be exit seller of ~50k SFRU5 9625c at 24 covered 9525.5 to 26, or synthetically down to 47 in the straddle. SFRU5 9625^ settled 48.0. Friday is the last day for MARCH sofr options. Next week September will be trading in the second quarterly slot. ATM March midcurve straddles are all 14.5 to 15.

DETOX

March 9, 2025 – Weekly Comment

*************************************

They tried to make me go to rehab, but I said “No, no, no”

Yes I’ve been black, but when I come back, you’ll know, know, know

–Amy Winehouse – Rehab

“…the market and the economy have just become hooked; we’ve been addicted to this government spending. And there’s going to be a detox period.”

–Treasury Sec’y Scott Bessent on CNBC Squawk box interview.

The lines just prior to the bit above: “…could we be seeing this economy that we inherited, starting to roll a bit? Sure. There’s going to be a natural adjustment as we move away from public spending to private spending”. Bessent and others have said the process will not be linear.

We’re going into rehab.

Momentous policy shifts across the globe necessarily come with massive capital shifts.

A recap of some of the week’s big news:

While it doesn’t appear as if government lay-offs have yet been captured in payroll data, “U-6* [under-employment rate] up 0.5% to 8%, largest one-month increase (excluding Covid) since 2009 and 2001 recessions; now 1.5% off low.” (Chris Long on LinkedIn). Headline Unemployment rate was up 0.1 to 4.1%. Both Powell and Bowman indicated a subtle shift in the Fed’s focus to the labor side of the dual mandate, rather than inflation.

SPX is down just over 6% from the high, and fell 3.1% this week. NVDA alone has shed nearly $1 trillion in market cap from the high in January. NDX is down 8.9% from the high. Are retailers foreshadowing a ‘reverse wealth effect’? COST -8% this week. TGT -7.3%. BBY -11.7%.

Atlanta Fed’s GDP Now for Q1 currently stands at -2.4%. Go back to Feb 19 and just change the sign, it was +2.3% just over two weeks ago!

The economy is slowing under the haze of uncertainty. Huge move in German bunds this week as Merz promises to do ‘whatever it takes’ to ramp up defense spending. Ten-year yield in Germany exploded by 43 bps to 2.836% even as the ECB (as expected) cut rates to 2.50%. EUR surged from 1.0378 last Friday to 1.0874. As an aside, @GlobalMktObserv shows that German GDP share of the global economy has halved in the past three decades, from 8.4% in 1990’s to an all-time low of 4.3% now. Hand-in-hand with Greta Thunberg and the green energy agenda. This week’s pivot has to be good for uranium/nuclear. Defense mfg requires energy apart from intermittent winds.

From my note last week: Chart above is EUR/JPY. I can’t help but feel that a large downside move is near. Then I wonder if perhaps Europe makes a U-turn… Perhaps huge investments in defense/tech are around the corner. Could Europe’s manufacturing base become rejuvenated? [EURJPY rallied from 156.27 to 160.36]

One other thing worth mention is a BBG podcast with Dawn Fitzpatrick, Soros CIO. The title is: ‘Investors Underestimate Trump’s Tolerance for Stock Selloff’. A couple of interesting notes: She says, “…what you can’t control is consumer confidence and corporate confidence, and I think that is what is falling off a cliff right now.” No mincing words there. She also says, because of US and European bond issuance, “…one of the things we might see, and this isn’t going to happen tomorrow, but I think it could happen in the next 12 to 24 months is a failed auction out of Europe.” Cites UK and France as most vulnerable. Other insightful comments on private equity and credit near the end. Well worth a watch. 17 minutes.

https://www.youtube.com/watch?v=Qv4qPPj5wI4

In the US rates popped from the year’s lows made last week. The curve steepened. 2s nearly unch’d at 4.00%, 5s +6.8 bps to 4.094%, 10s +8.5 to 4.315% and 30s +10.2 to 4.615%.

Rolling SOFR red/gold pack spread (2nd to 5th years) posted a new high for this year at 31.625 bps. High of the past three years was just under 41 bps in the wake of the Sept FOMC cut of 50 bps. This spread reflects renewed easing expectations – If the Fed is going to cut, short rates will fall faster than long rates. I suspect tens will chop around 4.20 to 4.40 for the next week or so. Ended Friday 4.315%.

This week on Thursday (13th) the Fed releases Z.1 flow of funds report for Q4. The financial press focuses on Household Net Worth. SPX on 9/30/24 was 5762. On Dec 31 it was 5882, up 2%. Interestingly we’re right back to end-of-Q3 level with Friday’s close 5770. Real Estate is always marked higher, though properties for sale in markets like Las Vegas and Nashville are exploding. From Melody Wright: “These 7 [metros] had negative [price] YOY sales per Redfin and an increase in inventory of greater than 20% YOY: Las Vegas, Tucson, Sacramento, Nashville, Austin, Dallas, Los Angeles”

On the week SFRM5 +1 at 9596.5. M6 -0.5 at 9643.0, M7 -8.0 at 9633.5, M8 -12 at 9621.0. Back end responding to German spillover, supply (US auctions 3s, 10s, 30s this week). Remember the guy that kept buying SFRZ5 9700c vs 0QZ5 9750cs for 2 to 3? Settles 15.0 vs 9632.5 and 11.5 vs 9640.5. But…it’s likely the same trader that had rolled his Z5 9700c to U5 9650c. Those settled 14.75. I think he mostly took in 0.5 on the U5/Z5 switch. U5 9650c have 250k open. 0QZ 9750c have 93k open. Largest trade Friday was a sale of over 50k SFRU5 9625c at 24.0 covered 9525.5 to 9526.0, 50d. Settled 21.25 vs 9619.5. Exit trade, OI down 43k in calls and 15k in futures.

CPI on Wednesday expected 2.9% yoy vs 3.0 last. Core expected 3.2% from 3.3%. Remember, the Fed is shifting focus from inflation to labor. Tuesday’s JOLTS might be just as important as CPI (expected 7665k from 7600k). Low last year 7372k. I wouldn’t be surprised if it is lower than that.

OTHER THOUGHTS, TRADES

My bias is to buy red sofr contracts on pullbacks. That opportunity could come this week. SFRM6 (9643) and U6 (9642.5) have been peak contracts on the SOFR strip and had powerful rallies since mid-February. For example U6 went from 9603 on 2/18 to 9649.5 on March 4. Could easily see a pullback towards 9620 to 25.

Looking at broken flies in Short July midcurves. March FOMC is almost certain to be a hold. Next meetings are May 7, June 18, July 30 and Sept 17. July midcurves expire July 11, SFRU6 underlying. July FF, FFN5, is close to being a ‘clean’ month. 31 days in July, FOMC is 30-July. The contract settled 9594.5 or 4.055%, reflecting one 25 bp ease. Current EFFR is 4.33% (and FFH5 settled exactly at 9567.0). One cut is 4.08% or 9592.0.

0QN6 9662.5/9687.5/9700c fly settled 4.5. 0QN 9687.5/9718.75/9737.5c fly settled 2.75. The reason I favor broken flies is that an unexpected event could shift rates sharply lower; broken flies at expiry would still show a profit. I would like to buy a bit cheaper than settles.

| 2/28/2025 | 3/7/2025 | chg | ||

| UST 2Y | 399.5 | 400.0 | 0.5 | |

| UST 5Y | 402.6 | 409.4 | 6.8 | |

| UST 10Y | 422.9 | 431.5 | 8.6 | wi 432.2 |

| UST 30Y | 451.3 | 461.5 | 10.2 | wi 461.7 |

| GERM 2Y | 202.5 | 224.7 | 22.2 | |

| GERM 10Y | 240.6 | 283.6 | 43.0 | |

| JPN 20Y | 202.7 | 223.1 | 20.4 | |

| CHINA 10Y | 177.8 | 184.5 | 6.7 | |

| SOFR M5/M6 | -48.0 | -46.5 | 1.5 | |

| SOFR M6/M7 | 2.0 | 9.5 | 7.5 | |

| SOFR M7/M8 | 8.5 | 12.5 | 4.0 | |

| EUR | 103.78 | 108.34 | 4.56 | |

| CRUDE (CLJ5) | 69.76 | 67.04 | -2.72 | |

| SPX | 5954.50 | 5770.20 | -184.30 | -3.1% |

| VIX | 19.63 | 23.37 | 3.74 | |

| MOVE | 104.46 | 104.41 | -0.05 | |

U-6 is Total Unemployed, Plus All Persons Marginally Attached to the Labor Force, Plus Total Employed Part Time for Economic Reasons, as a Percent of the Civilian Labor Force Plus All Persons Marginally Attached to the Labor Force (U-6)

Payrolls & Powell

March 7, 2025

***************

–Payrolls today expected 160k from 143 last. Unemployment rate expected 4.0%, unchanged from last. Powell speech on the Economic Outlook at 12:30.

–Midcurve March SOFR options expire in one week. 0QH5 9643.75^ settled 20.25 (ref 9643.5), quite high for a one-week period, but not an easy sale given the backdrop.

–Yesterday’s action was dominated by weakness in equities, SPX -1.8% and Nasdaq Comp -2.6%. There’s plenty of chatter about oversold conditions, 200 day moving averages, bear market bounces. However, the broader geopolitical environment is undergoing a massive generational shift, necessarily impacting capital/investment flows. For now, uncertainty is restraining risk appetite. Short-term technical considerations and economic data are just noise. I’m not saying that equities necessarily have an abrupt shift lower, just open to that possibility in a broad spectrum of scenarios. Crashes don’t occur from highs, but rather from lows. In the first two years of Reagan’s first term, SPX fell nearly 30%.

–Yesterday Waller rejected the idea of a March ease, yet April FF still settled 9570 or 4.30%, 3 bps of premium to the Fed Effective of 4.33. Waller did add ‘there’s nothing wrong with a forecast of 2 rate cuts this year’. July Fed Funds settled +5.5 at 9599.5 or 4.005%. So FFN5 has more than one ease priced, with three FOMC meetings before-hand: March 19, May 7 and June 18.

“Bessent says he will pursue reform of the enhanced SLR ratio to prevent it from acting as a binding constraint – to improve Treasury market intermediation” (Nick Timiraos). Translation, we’re going to need to find buyers for all these bonds: the big banks. TBTF banks siphoned a lot of low cost deposits post-SVB, so even though repo rates presently indicate negative carry, the big banks have plenty of cushion.

–One notable pre-NFP trade: buyer of 50k FVJ5 108/108.5cs 8.5. Settled 10.5 ref 107-2575. Curve was again steeper with red SOFR contracts to deferred making new highs. SFRM5 +5.0 9600.5, M6 +1.5 9646 (peak contract), M7 +0.5 9637.0, M8 -1.0 9624.5.

So, SFRM5/SFRM6 1-yr calendar is NEGATIVE 45.5 in expectation of lower future rates, while SFRM6/M7 is POSITIVE 9 (new recent high).

The surge in German bund yield (40 bps this week) has spilled over into the US curve. US 2y FELL 2.1 bps to 3.965% while 10s ROSE 2.3 bps to 4.286%.

Global bond rout

March 6, 2025

***************

–The on/off uncertainty inspired by the current administration appears to be resolving with risk assets paying the price. Stocks starting off on the back foot with ESH5 currently in the red about 66 points near 5785, down about 1.2%. Of course, less than stellar earnings also playing a part. The proximate culprit is a global bond sell-off led by the German bund. On Friday Feb 28, the yield was 2.40%. This morning, going into the ECB and a European emergency summit on defense/Ukraine, it’s 2.85%. ECB expected to cut 25. German 2/10 was 39 bps on Friday, now 63. I saw a clip by Doomberg expressing skepticism that Europe’s grand defense plans have much hope of getting off the ground, due to the limiting factor of not enough (green) energy.

(Example of poor earnings: MRVL, a chipmaker, down 15% this morning).

–ISM Services and Prices yesterday both higher than expected 53.5 (52.5 exp) and 62.6 (60.4). ADP was just 77k vs expected 140k going into tomorrow’s payrolls. NFP expected 160k. Largest trade yesterday was in TYK5 113.5 calls, with a total volume of 254k! Open interest fell 50k. Initial trade was a block sale of 85k at 21 covered 111-035, 22 delta. More sales followed down to 12.5k at 19 covered 111-025. Over 100k on the day. Huge buying over the past couple of weeks in lower strike TYK calls has reversed. TYM last price 110-21 vs 111-025s.

–Ten year yield ended at 4.263%, up 5.3 bps on the day. As of this note on Thursday morning, 10y yield is 4.296%. Curve a bit steeper at the close, with 2s up only 3.1 bps to 3.986. SOFR strip also steeper as bund weakness permeated the entire interest rate spectrum. SFRM5 -2.5 at 9595.5, M6 -4.0 at 9644.5 (now peak contract on the strip), M7 -7.5 at 9636.5 and M8 -8.0 at 9625.5. Worth noting is new high in yen, with $/yen now 147.91. The aggressiveness of the fall in $/yen doesn’t match what was seen in early August but the absolute level is similar. On Aug 1, low was 148.51, by Aug 5 it had plunged to 141.70.

‘There’ll be a little disturbance but we’re ok with that’

March 5, 2025

***************

“a little disturbance” is the only thing I saw regarding the Trump speech last night, and for once, he seems to be prone to “a little” understatement.

–Wild price action across markets. This morning CLJ5 is 67.08, down 1.18, right back to Nov and Dec levels from a high near 78 in mid-Jan. Long end of the treasury market is lower after reversing from new highs yesterday. (e.g. USM5 current 117-25 after a high 119-18 yesterday). German bund remains pressured after plans to ramp up defense spending. German 2/10 was 29 at the start of the year and now 52 bps. 10y bund yield 2.68%, testing the high of 2024 (2.69). The high in 2023 was just a shade under 3%.

–Treasury curve steeper yesterday. 2y down 2.5 bps to 3.955% with 10s +3 bps to 4.21%. 5/30 in US made a new recent high at 51.4, up 4.2 bps on the day. SOFR strip tells the same story: Near calendar spreads at new lows as reds led on the upside, spreads from reds forward made new recent highs, as blues and golds were weakest. Selected settles: SFRM5 +1.5 at 9598, M6 +3.5 at 9648.5, M7 -1 at 9644 and M8 -3 at 9634. M5/M6 at new low -50.5. M6/M8 at new recent high 14.5; high in January was 21.

–May FF saw renewed action. A couple of weeks ago, buyer of 110k for 9571. Exited mostly at 9573.0. Yesterday he jumped in again, buying 42k at 9577 and 10k at 77.5. Settled 9577. If Fed does NOT go in March but does ease 25 at May 7 FOMC, then FFK5 should settle 95.864. So, assuming March is dead (and it’s most certainly not!) the buys of FFK at 77 are about 50/50… 9567 is no ease, or nearly 9587 on 25 cut in May.

–Early Tuesday morning (Asian hours) there was a block sale of 78k TYM5 111-19, reportedly the largest ever. Open interest fell 124k yesterday, so appears to be profit-taking. Yesterday settlement was 111-08.

–A couple of trades to highlight: in SOFR a new buy of 60k 0QM5 (june midcurves) 9700/9750cs for 7.25 to 7.5. Settled 6.0 ref 9648.5 in SFRM6. There has been large buying of May TY calls. Yesterday a seller of 32k TYK5 112.5c vs buying 35k TY wk4 114c. Settles 40 and 7. Open int down 18k in May and +35k in week-4. TYK options expire 25-April; the calls had 33 delta. Week-4 calls have only 10d, and expire 28-March. So the wk-4 expire 4 weeks earlier; looks like he took some money off the table but kept some tail upside in case the wheels come off.

–Yesterday I had mentioned that BBY and TGT earnings might give clues on the health of the consumer. Both companies indicated little growth in sales going forward (negative in real terms). BBY -13.3% on the day. TGT -3.0%.