Presidents’ Day market notes

February 18, 2024 – Weekly Comment

****************************************

Just three brief observations this week. 1) SFRM4, SFRH5 comparison 2) Huge increases in TYJ put buying 3) Red/green SOFR calendar

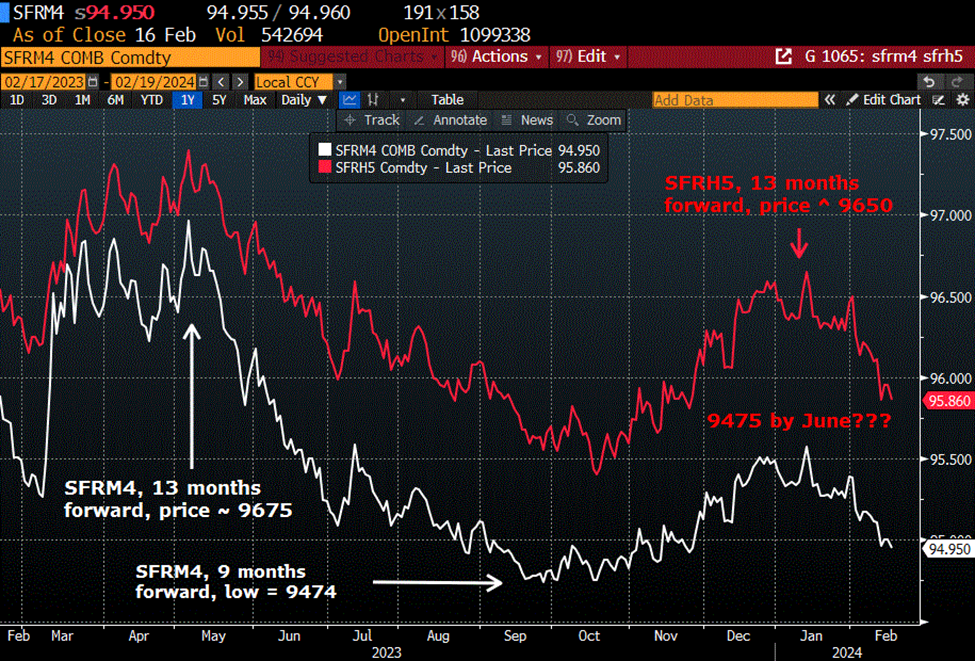

In the beginning of May 2023, when concerns about the (regional) banking system were still tender, SFRM4 traded around 9675. The high settle had been 9696 on May 4. It then began a protracted slide with a low settle of 9474 in late September. In May, SFRM4 was about 13 months forward. At the September low of 9474 it was just under 9 months forward. Note that on both May 3 and July 26 the Fed tightened 25 bps, skipping the June meeting. Note also that in April 2023 CPI was 4.8, in May 2023, 4.0 and in June 3.0. Last week’s reading for January was 3.1. The July hike has been the last one.

Now consider SFRH5, which is currently about 13 months forward. It recently traded above 9650 (high settle 9664.5 on Jan 12) somewhat close to where SFRM4 was at the same time of its life. However, as noted above, hikes had occurred in May and July. The recent sell off in SFRH5 hasn’t been quite as fierce as the spring drop in SFRM4, but if the same general pattern were to hold (and the Fed stands pat), one might expect another 100 bps or so to the downside by June. SFRH5 settled Friday at 9586. With that in mind, consider SFRH5 put spreads or midcurve June’24 put structures on SFRM5. In August to Sept SFRM4/U4 was -37 to -25; when SFRM4 traded to 9475 SFRU4 was around 9502. Given that level of inversion, one might target 9525 to 9500 in SFRM5 (current 9607) the contract just forward from SFRH5. For example, 0QM 9562.5/9537.5/9512.5/9487.5 put condor settled 3.75. Assuming a price of 4, breakevens are 9558.5 and 9491.5. Max value 25 between the center two strikes. Expiration 6/14/24.

THIS IS NOT MARKET ADVICE OR A RECOMMENDATION

This trade is sort of a ‘Larry Summers’ play. Last week he said, “There’s a meaningful chance – maybe it’s 15% – that the next move is going to be upward in rates, not downwards.” (How many can I put you down for Larry?). Actually, if talking about the ‘next move’ in terms of an actual hike in the FF target, I think there’s way less than a 15% chance. However, that doesn’t mean that the forward curve can’t shift to higher rates. Higher forward rates should be marginally negative for equities and employment, which in turn should keep Core Service inflation on a downward path. The Fed does not have to overtly hike. Leaving short rates well above inflation works to restrain the economy over time, and coming corporate debt rollovers will become more difficult.

This brings us to point number two, the tremendous amount of buying in TY puts last week, mostly April expiry. Between Thursday and Friday, total open interest in TYJ puts went up by 260k contracts, about 130k each day (to a total of 665.7k). Clearly some of this buying is replacing coverage of March options, which expire Friday. However, it’s still somewhat surprising to see aggressive buys just prior to a three-day weekend, in front of a week that contains little in the way of economic news/data. On Friday there was a late buyer of 15k TYJ4 106.5p for 6 (OI +21k to 29k) and 40k TYJ4 106p for 5 (OI +36k to 41.5k). Early buy of 10k TYJ4 108.5/107.5ps for 11; relatively small delta buys. Thursday’s buys in 110 and 109.5 puts were higher delta, but in any case the overall totals are impressive. On a week which featured higher than expected CPI and PPI data, the 5y yield rose 13.7 bps to 4.286% and tens nearly 11 bps to 4.293%. I would note that April options expire 22-March, just after the FOMC. NFP is March 8, and Powell testimony in front of Congress is March 7.

On the SOFR curve SFRH5 saw the largest net decline, settling -23.5 to 9586. More deferred contracts fell the same sort of magnitude as the 5y and 10y. In this regard, it’s worth looking at the constant maturity red/green SOFR pack spread; red pack is currently the average price of 2025 contracts and green pack is avg of 2026 contracts. [chart below] This spread fell by about 7 bps on the week to -19.5, with the red pack -21 (9632 to 9611) and the green pack -14.5 (9645 to 9630.5). [rounded]. As shown on the chart below, this spread is now at a strong support area. My bias is that it will hold, but if Larry Summers’ sentiment gains wider currency then the spread could test -35 and all rate futures would likely be under selling pressure.

One last quick note concerns the strength in WTI. CLJ4 settled 78.46, up 1.69 on the week; highest settle since early Nov. Near contracts trade at a growing premium to deferred. For example, April 24 contract settled 78.46 and April’25 (CLJ5) at 72.39, a spread of 6.07. On a rolling basis this spread was just 0.28 in December. Strength in near contracts and widening spreads occurred last summer, culminating with a September high in the 2nd to 14th monthly contract (1-yr) spread of 12.20. This period also corresponded with a surge in treasury yields. (Thanks PMV)

One year rolling CL spread, 2nd to 14th.

| 2/9/2024 | 2/16/2024 | chg | ||

| UST 2Y | 448.6 | 465.2 | 16.6 | |

| UST 5Y | 414.9 | 428.6 | 13.7 | |

| UST 10Y | 418.5 | 429.3 | 10.8 | |

| UST 30Y | 438.0 | 444.6 | 6.6 | |

| GERM 2Y | 271.6 | 281.6 | 10.0 | |

| GERM 10Y | 238.2 | 240.2 | 2.0 | |

| JPN 20Y | 150.9 | 151.2 | 0.3 | |

| CHINA 10Y | 243.9 | 243.9 | 0.0 | |

| SOFR H4/H5 | -132.0 | -115.0 | 17.0 | |

| SOFR H5/H6 | -38.0 | -45.5 | -7.5 | |

| SOFR H6/H7 | 6.5 | 3.0 | -3.5 | |

| EUR | 107.84 | 107.79 | -0.05 | |

| CRUDE (CLJ4) | 76.77 | 78.46 | 1.69 | |

| SPX | 5026.61 | 5005.57 | -21.04 | -0.4% |

| VIX | 12.93 | 14.24 | 1.31 | |