Rumbling beneath the surface

May 21, 2023 – Weekly comment

*******************************

In the past week, yields rose aggressively. The five-year ended at 3.74%, up about 30 bps on the week. The thirty-year bond added 17 bps, to 3.944%. On the SOFR curve, June’24 (SFRM4) was the weakest, down 39 bps in price to 9625.5 or 3.735%.

The treasury curve flattened with 2/10 down about 6 bps to -60 bps. On the SOFR curve the SFRM3/SFRM4 one-year calendar soared 30.75 bps from -173 to -142.25 (9482.25/9526.5) while SFRM4/SFRM5 fell 8.5 to -64 (9526.5/9690.5); both moves due to relative weakness of SFRM4.

All rates had plunged in March due to the SVB banking earthquake, but are now retracing as aftershocks become muted rumbles (though Yellen warned of more banking consolidation). The 2y yield has retraced about 38% of the March swan dive from 5.07% to 3.77%. The ten year yield about 50% from the March high of 4.06% to the early April low of 3.31% and the 30y bond nearly 90% from the March high of 3.99% to the early April low of 3.55% (now 3.94%).

In terms of Fed policy, officials appear divided on whether or not to pause in June. For example on Thursday Logan said we’re not quite there in terms of evidence which would support a pause, but on Friday Powell said the balance of risks between tightening too much or too little were about evenly balanced. July Fed funds settled 9487.5 or 5.125% which is 4.5 bps over the current EFFR of 5.08. Of course, a hike in June would cause EFFR to go to 5.33 or 9467.0, and there’s another FOMC on July 26, worth 4 bps to FFN3 on a 25 bp hike at that meeting. Ignoring the July meeting, FFN3 is reflecting odds of 18% for a hike at the June FOMC.

An issue for the Fed, which they have been jawboning against, is that when the market perceives an end to hikes, the next move is naturally presumed to be an ease. Of course, that has been abundantly clear on the SOFR curve: even though SFRM4 fell 39 bps this week, it still is at a yield 142 bps lower than SFRM3. If I were the Fed, I would want to convince the market that rates can be HELD at relatively high levels for a few quarters, in order to really tamp down on higher inflation expectations. It’s not the exact level that’s critical, it’s the duration. PCE prices are released on Friday, expected 4.3% yoy with Core 4.6% vs 4.6% last. With FF 5-5.25%, one can easily argue the Fed is now in restrictive territory. I would say that in the past week, the Fed has been successful in terms of paring back future easing expectations. For example, SFRM3/SFRZ3 spread settled 12-May at -75, but rose to -55.75 by Friday, i.e. the forward rate reflected in the end of the year contract increased. In my opinion, the Fed should continue to talk about higher rates, even after pausing in June. As Powell alluded to on Friday, stricter credit allocation due to the banking shake-up cannot be quantified yet, and the Fed will just have to monitor how much restraint is actually imposed on economic activity and inflation.

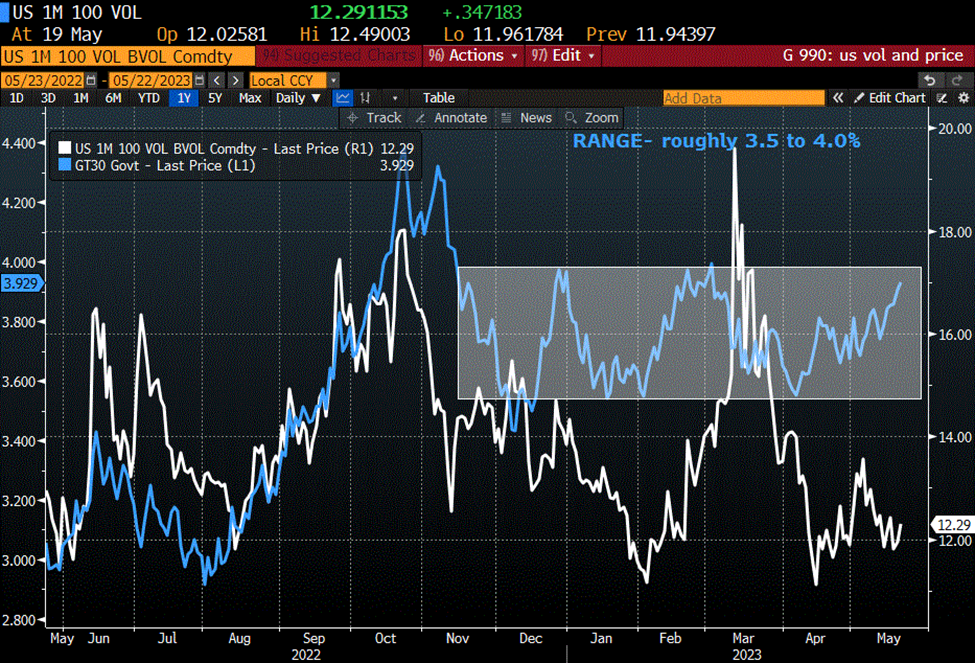

However, there is another looming issue which could send shockwaves through markets, and that of course, is the debt ceiling. VIX and MOVE are suggesting a complete lack of concern, with the former near 12-month lows and the latter well off the highs from March and slightly below the average for the past year.

The Market Huddle with Kevin Muir featured a fascinating discussion with Jim Leitner covering the debt ceiling. Leitner thinks the market is underpricing the risk of default and believes participants may begin to question the safety of treasuries. If that were to happen it would have far-reaching negative consequences as treasuries are used system-wide for collateral. He gives a hypothetical example of a futures broker suddenly declining to take treasuries as margin, causing massive forced position unwinds. He also mentions the 14th Amendment, which might allow Treasury to continue issuing debt even without a debt-ceiling agreement. Here’s a link to a short article explaining that scenario:

https://www.ncsl.org/state-legislatures-news/details/the-debt-ceiling-and-the-14th-amendment-the-jury-is-still-out#:~:text

From the article:

Some scholars say that Biden could argue that the government is required to pay its bills and that the language of the constitutional clause supersedes the statute limiting the size of the federal debt.

The point is that things could get sloppy quickly. Leitner mentioned he’s long TY 111p for end of June (I assumed he means TYN3 111p which settled 10/64, -0.11d). He indicated that he had bought for protection as opposed to a high expectation of ‘win’. A couple of weeks ago I suggested buying otm US puts as the yield on the 30y approached the recent range low of 3.5%. On the next page is a chart showing bond (US) vol overlaid with the yield on the 30-yr. From August to October of last year, vol strengthened right along with the surge in yields. In the March SVB fiasco, vol screamed to new highs as yields plunged. Currently the 30y yield is marching higher, but it’s not yet through the upper end of the recent range. However, if that’s what vol did when a regional bank couldn’t meet its obligations, imagine where it might go if the Federal Gov’t fails to honor the sanctity of its debt.

Apart from the debt limit, other things to watch this week are:

Fed speakers:

Bullard and Daly on Monday. Might cancel each other as Daly typically parrots Powell.

Logan (again) on Tuesday

Waller on Wednesday followed by the FOMC minutes

PCE price data, the Fed’s preferred measures, are released Friday.

I don’t typically follow earnings reports closely, but NVDA, which has a market cap of $733b reports on Wednesday; the stock has more than doubled from the end of last year, from 146 to 312 as AI fever builds. There are also a lot of retailers reporting next week which might provide more of a read on the consumer. Some of them:

Monday: Nordstrom

Tuesday: Lowes, Dick’s Sporting, BJ’s Wholesale

Wednesday: Kohl’s, Petco

Thursday: Costco, Best Buy

OTHER THOUGHTS / TRADES

Though the curve flattened, USM3 appears more inclined to an upside breakout in yield terms. July option expiry is June 23, which is after the June 14 FOMC. With USU3 settle at 127-11, USN3 120p settled 0’14 with a delta of -0.08. DV01 on the contract is approx $147, so a full point is ~6.8 bps. Current 30y yield is 394.4, so 4% should equate to 126-16 or so. A breakout above 4% would likelly result in another 25 bps relatively quickly. The 30y high yield from last October was 4.38% and the front contract at that time traded below 118.

There are a tremendous amount of option trades predicated on the settlement of SFRM3 on 16-June. My bias is for a settle above 9493.75, though I think it’s quite unlikely at this point to get above 9506.25 (unless the debt-ceiling wheels fall off). On the put side, SFRM3 9493.75 puts have the most open int at 650k, settled 13.5 vs 9484.25. On the call side the 9500s has 309k open, settled 3.25.

| 5/12/2023 | 5/19/2023 | chg | ||

| UST 2Y | 399.1 | 428.5 | 29.4 | wi 423.0/22.5 |

| UST 5Y | 344.3 | 374.2 | 29.9 | wi 371.0/70.0 |

| UST 10Y | 345.5 | 368.8 | 23.3 | |

| UST 30Y | 377.5 | 394.4 | 16.9 | |

| GERM 2Y | 259.4 | 275.7 | 16.3 | |

| GERM 10Y | 227.6 | 242.7 | 15.1 | |

| JPN 30Y | 123.9 | 123.2 | -0.7 | |

| CHINA 10Y | 270.6 | 271.9 | 1.3 | |

| SOFR M3/M4 | -173.0 | -142.3 | 30.8 | |

| SOFR M4/M5 | -55.5 | -64.0 | -8.5 | |

| SOFR M5/M6 | 2.5 | -0.5 | -3.0 | |

| EUR | 108.50 | 108.06 | -0.44 | |

| CRUDE (CLN3) | 70.02 | 71.69 | 1.67 | |

| SPX | 4124.08 | 4191.98 | 67.90 | 1.6% |

| VIX | 17.03 | 16.81 | -0.22 | |

on May 21, 2023 at 1:50 pm

Permalink

Greetings Mr. Manzara,

Just wanted to express my gratitude for the work and writing you do at Chart Point. I’m 43, so I straddle the traditional market notes and the twitter thread age. I miss the blog era of individual market participants expressing their thoughts about the guts of what’s taking place within markets, When the blog era started I cherished the original Macro Man blog, and a few various others as I found them exceedingly refreshing against the traditional sell/buy side notes. So just wanted to send a quick letter reflecting my thanks, I throughly enjoy your weekly musings.

Hope you are having a great weekend Sir,

Ryan