Taketh Away

April 6, 2025 – Weekly Comment

**********************************

We all know what happened.

SPX and Nasdaq 100 made new all-time-highs in mid-February. From Tuesday, pre-Liberation day, to Friday’s close, SPX down 12.2% and NDX down 14.2%. From Feb highs to Friday, SPX -17.4% and NDX -21.5%. Worth noting is that from the high at the start of 2022 (4794) to the low in October (3583), SPX fell 25%. We’re not there yet.

As of Friday’s close, we’ve retraced 42% of the 2022 low to February’s high. Massive increase in perceived wealth followed by a loss in perceived wealth.

Halfway back would be 4863, and the 2022 high was 4794. Should be a support area. Now 5074.

The questions are: what’s an appropriate template going forward for markets and the economy? Is this a sea-change in global trade and standards of living?

In Q4 2018, the Fed was in a hiking/QT regime, and SPX fell 20% in Q4. Though there was an emergency Treasury dept meeting and announcement, the Fed’s final hike was in December (followed by a delayed pivot and ease at end of July 2019). Rates had, of course, anticipated the ease, as twos fell from around 2.75% in mid-Dec 2018 to 1.75% by June 2019. Currently twos have fallen from 4.36% in Feb (pretty much equal to current EFFR of 4.33) to 3.66% Friday, or 70 bps.

The COVID sell-off in Q1 2020 went from a high in SPX of 3386 on Feb 19 to 2237 on March 23, a loss of 34%.

My personal bias is that this week’s actions could lead to further deterioration in global trade, and a generational stall/decline in US living standards. I could easily be wrong, but I don’t think this damage is undone with a pen stroke. Powell said on Friday that the Fed is in no hurry to cut rates, and is looking for confirmation in hard data. He expects tariffs “…are likely to raise inflation in coming quarters.” The market is telling us the Fed will be easing shortly, and that the decline this year is likely to be larger than the 50 bps penciled in at the March Survey of Projections for 2025.

May FF settled Friday at 9575.5. The FOMC is 7-May. No ease is 9567, an ease of 25 bps would be 9586.5 (7*4.33 + 24*4.08)/31. So as of Friday, not quite 50/50. The last FOMC of this year is 10-Dec. January 2026 FF settled 9668.5 or 3.315%, essentially 1% lower than the current EFFR of 4.33%, or twice as much as the Fed projection. FFF6 rallied 27 bps on the week. Peak contract on the SOFR strip is still the sixth slot (2nd red), SFRU6 at a price of 9693.5 or 3.065%. That contract traded a high price of 9719.5 on Friday.

For the sake of comparison, I am adding a chart of the rolling FIRST red, delineated by BBG as SFR6, on a chart going back almost to the start of this hiking cycle. First red, currently SFRM6 at 9690. Friday high was 9716.5.

The chart makes it look pretty easy. Sell it up here and book a 75 bp profit. However, the last couple of times the FF target was 50 to 100 bps higher than it is now. So no, it’s not that easy. Also, the last couple of times, the economy was in a period of fiscal dominance. Now we’re in a period of fiscal retrenchment. I’m not saying reds won’t retrace 50 to 75 from Friday’s close. Just saying it’s a little different.

The Fed eases to maintain economic activity in the face of uncertainty. On Friday Powell indicated the Fed can be patient. I don’t think so. JPM says 60% chance of recession. I don’t think so. We are 100% in the midst of recession now. Q1 GDP advance is released April 30. Atlanta Fed Q1 GDPNow is -2.8%. Gold-adjusted it’s -0.8%. Next payroll data May 2. FOMC is May 7.

Powell on Friday:

The limited hard data are consistent with a slower but still solid growth outlook. At the same time, surveys of households and businesses report dimming expectations and higher uncertainty about the outlook. Survey respondents point to the effects of new federal policies, especially related to trade. We are closely watching this tension between the hard and soft data.

Turning to monetary policy, we face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation.

While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and slower growth. While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.

Just a couple of more market notes. On a settlement basis, CLK5 (WTI) fell 10.6% this week. Low for the front contract since 2021.

Ten year treasury-tip breakeven fell 19 bps this week to 218. Low of last year, since 2021, was 203. High so far this year is 247.

Remarkable that 2/10 is just sitting in middle of this year’s range. Last at 33, high in Jan is 42. Red/gold spfr spread 42.75, new high for the year and just thru last September high of 41. I would expect further steepening.

BBB corporate to 10y treasury spread has risen from 104 bps in mid-Feb to 136 now. Yen-carry peak in August was 139. A few weeks ago I had mentioned HYG (hi-yield etf). I was long some puts for March expiry that barely scratched out a profit. Wish I reloaded, but I didn’t. That’s just the nature of trading. HYG low close in March was 78.52. This week a plunge down to 76.76, again, testing the level of the Aug 5 yen-carry volatility.

I now think red SOFR contracts see a soft cap around 2.5% or 9750. Could easily see spikes above that level, but I don’t think they would be sustained. To give an indication of a reach, on Friday SFRZ5 9900c 4.0 paid 10k. Settled 3.0 ref 9665.5. SFRZ5 9800c settled 8.5.

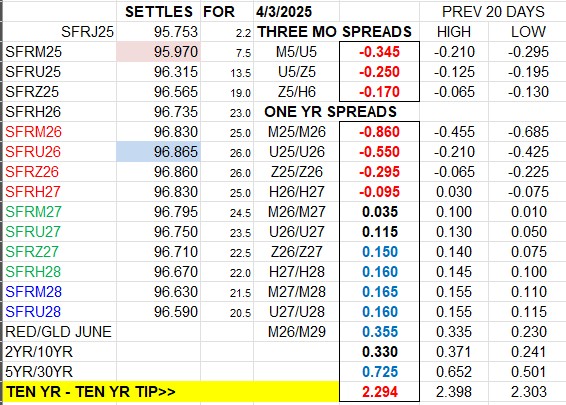

On the week, the contract that rallied most was the peak SFRU6, up 35 to 9693.5. However, on Friday the front contracts were strongest, with SFRM5 and SFRU5 both +10.5, to 9607.5 and 9642.0. Friday to Friday, SFRM5 +14 and U5 +22.5. I think SFRM5 can ultimately settle 9618 to 9625.

| 3/28/2025 | 4/4/2025 | chg | ||

| UST 2Y | 390.6 | 366.8 | -23.8 | |

| UST 5Y | 397.9 | 371.2 | -26.7 | |

| UST 10Y | 425.3 | 399.1 | -26.2 | wi 398.0 |

| UST 30Y | 463.1 | 438.9 | -24.2 | wi 439.3 |

| GERM 2Y | 201.9 | 182.7 | -19.2 | |

| GERM 10Y | 272.7 | 257.8 | -14.9 | |

| JPN 20Y | 224.5 | 195.6 | -28.9 | |

| CHINA 10Y | 181.5 | 172.0 | -9.5 | |

| SOFR M5/M6 | -62.5 | -82.5 | -20.0 | |

| SOFR M6/M7 | 3.0 | 5.5 | 2.5 | |

| SOFR M7/M8 | 15.0 | 16.0 | 1.0 | |

| EUR | 108.28 | 109.61 | 1.33 | |

| CRUDE (CLK5) | 69.36 | 61.99 | -7.37 | |

| SPX | 5580.94 | 5074.08 | -506.86 | -9.1% |

| VIX | 21.65 | 45.31 | 23.66 | |

| MOVE | 96.83 | 125.71 | 28.88 | |

Forced to react

April 4, 2025

**************

–SPX -4.8% and Nasdaq Comp -6% yesterday, with somewhere around $2.5T erased, according to various reports.

–SFRU6 is still the peak on the SOFR strip, but now much higher having surged 26 bps yesterday to 9686.5. The calendars in front made new recent lows (red), and calendars from Z6 forward made new highs (blue). SFRM5/M6 is most inverted at -86.0 (9597, +7.5 & 9683.0, +25.0). Simplistically, one might say they priced [an additional] 25 bp ease into reds. In treasuries, 2’s down 18 bps to 3.723%, 5’s were the leader down 19.2 to 3.759% and tens down just 14.2 bps to 4.053%. In the old days that might have meant a 30y fixed mortgage at 5.375%. Not now.

–Vol exploded. I have thought that 3% is sort of a soft cap for reds in terms of price/yield. This morning’s high in SFRU6 is 9699.5, so we’re there. However, if short calls in SOFR against the backdrop of a massive loss in perceived wealth, you don’t have the luxury of “sort ofs”. There is only open ended risk that must be capped. Just for the sake of comparison, on March 17, SFRM6 settled 9637.5 and the atm straddle was 90 bps. Yesterday M6 settled 9683, nearly 50 bps higher, and the 9687.5^ settled 95.75.

–Today NFP expected 140k. Yesterday’s employment component in ISM Services was 46.2, takes out the lows for 2024. Powell speaks at 11:25. He’s not going to say the Fed’s easing, but get a couple of more days like this and he will. Certainly he will say the Fed is watching employment carefully and will react if conditions deteriorate. Yesterday’s Atlanta Fed GDP Now at -2.8% for Q1. Gold-adjusted it’s -0.8%.

–SPX at the close has taken away HALF of last year’s rise. On a closing basis, the low in 2024 was 4688 on 4-Jan and the high was 6090 on 6-Dec. That low to high was a gain of 29%.

Markets shaken, not stirred

April 3, 2025

*************

Buy bonds?

–Nasdaq futures had a swing greater than 6% following the start of the tariff announcement, posting a high of 20044 and a low of 18819, 1225 points. For now, asset prices are on the defensive, and of course, there will be forced sales in some cases.

–Rate futures rallied to new recent highs. In this session so far, red SOFR contracts traded up 20 or so. High in SFRU6 has been 9681 (+20.5). After last year’s yen-carry rally (going into the first ease of September 2024) red SOFR contracts traded 9710 to 9725. Currently the front June contract SFRM5 is only +3.5 at 9593 (high of 9597). The market seems to be concluding that the inflation implications of tariffs will keep the Fed sidelined over the near term. I think that assumption is erroneous, but I suppose it will take some time to see if a negative wealth effect materializes. Current equity futures are only -2.8% on ESM at 5554 and -3% on NQM5 at 19165.

–Ten year yield ended at 4.195%, up 3.8 bps yesterday, but flirted with 4% this morning, low of 4.038. Current 4.07. 2/10 ended 29.1 at yesterday’s future settlement time (pre-speech) but is only 28 now. If they thought an ease would be forthcoming, curve would be steeper.

–News today includes Trade Balance, Jobless Claims at 225k, and ISM Services expected 52.9 from 53.5. NFP tomorrow and Powell speaks.

–An article on Reuters: ‘Greek feta producers fret over exports after US tariffs’. Now that’s going to sting.

Front end of SOFR curve inverts to new recent low

April 2, 2025

**************

–To Scott Bessent: the good news is that long end rates are falling. The bad news is it’s because the economy is disintegrating.

–Almost every piece of data is showing a reversal of the election bounce. ISM Mfg interesting. The main number at 49.0 now indicates contraction. But prices paid soared to a new high 69.4. At the same time, new orders are plunging, now at 45.2 (lower than all of 2024). One could be forgiven for this interpretation: Purchasing managers are BUYING now and securing supplies to beat the tariffs. But they’re not going to be selling as much. Will likely get caught with unintended inventory. And THAT is recessionary.

–It’s tariff day. Also, ADP expected 120k. Capital Goods Orders non-defense ex-air -0.3 last (hopefully turn positive). Fed’s Kugler gives a speech this afternoon on Inflationary Expectations and MonPol. That speech might be overshadowed by, ahem, other factors. Headline just out this morning says *CHINA SAID TO RESTRICT COMPANIES FROM INVESTING IN THE US.

–Yesterday featured curve flattening. 2’s fell 4.5 bps to 3.865% while tens dropped 8.7 bps to 4.157%. Twos are nearly 50 bps below current EFFR of 4.33. New low inversion in SFRM5/M6 one-year calendar at -67.5 (9594, +2.0 & 9661.5, +6.0). Early last September, following the yen-carry debacle, going into the first FOMC ease, what was then the front one-yr calendar SFRU4/U5 got as low as -200. (This was of course, before 100 bps worth of easing). By October, the front one-year calendar was SFRZ4/Z5 and that was around -100, rallying into the election to -50. At -67, the current 1-yr spd loosely forecasts 2 to 3 eases. Yesterday’s SFRM6 settle at 9661.5 (and all reds) was the highest since October of last year.

Yesterday’s push to lower yields fizzled. Today’s the day?

April 1, 2025

*************

—Flight to quality bid Monday evaporated as stocks stabilized. TYM5 posted an early high of 111-225 but came back to settle 111-07, up just 0.5/32. Trade of the day was new buy of 60k SFRZ5 9625/9650/9675/9700 call condor for 5.0. Settled 5.0 vs 9637.5. Max value occurs at settle between middle two strikes which would be consistent with FF target 3.25/3.5 vs current 4.25/4.5. The last FOMC projected two cuts for end-of-2025 to 3.875% mid, this guy is looking for four.

–Major data of the week will be Payrolls on Friday, looking for 130 to 140k, with the unemp rate unch’d at 4.1% (high rate over the past year has been 4.2%). Powell speaks on economic outlook post-payrolls. Today we have JOLTS expected 7655k vs 7740k. ISM Mfg expected 49.5 vs 50.3. Prices expected 64.6, likely skewed by tariffs. Employment 47.2 from 47.6. Tariff announcement tomorrow. Fed’s Kugler speaks Wednesday afternoon on “Inflation Expectations and Monetary Policymaking”. Given the current surge in expectations, versus relatively muted market indicators, it should be interesting.

–This morning the bond bid is back. with TYM5 currently 111-20+, near yesterday’s high even though ESM5 is nearly unchanged. Highest contract on the SOFR strip is SFRU6 which settled 9657.5. The highest this contract has traded since last October is yesterday’s high at 9666.5. Currently 9663. On a technical basis, it appears ready to break out for a move nearing 9700.

Assets have risk

March 31, 2025

*****************

–Stocks under follow-thru pressure following a poor session Friday. SPX was down 2% and Nasdaq Comp -2.7%. SPX ended 5581. I would think a reasonable target would be somewhere around 4800 to 5000. High at the end of 2021/start of 2022 was 4819. The halfway back level from the 2022 low of 3491 to this year’s high of 6147 is 4819. A 20% drop from this year’s ath is 4918. Obviously that sort of move would take some time, but in the five months from October 2023 to end of March 2024, SPX surged 1144 points. The Feb high of 6147 minus 1144 is 5003.

–Friday’s trade in rate futures felt somewhat more urgent. SFRH6 thru SFRH9 settled up 11.5 to 12.5. Five yr was the leader on the treasury curve, sinking 11.9 bps to 3.979%, while tens fell 11.4 to 4.253%. The most inverted one-yr SOFR calendar is front SFRM5/M6 which settled at a new recent low -62.5 (9593.5/9656.0). At a price of 9593.5 in M5 the yield is 4.065%, which is right around a 25 bp ease; EFFR is currently 4.33% and would move to 4.08% on a cut.

–As mentioned in yesterday’s note, PCE data mixed: Personal Income was up a solid 0.8% but Spending only 0.1%. Prices were slightly firmer than expected with yoy 2.5% and Core 2.8%. More worrisome were final University of Michigan survey data. The one-yr inflation measure edged up to 5%. The Economic Expectations number was dismal at 52.6. There are just a few lower readings: 2008 at 49.2 and 2009 at 50.5 (GFC). 2011 at 47.6. 2022 is the lowest at 47.3.

–End of month and quarter today. Chgo PMI expected 45.0 from 45.5. Tariff day tomorrow.

–Just another couple of broad strokes regarding international capital flows. Market Huddle featured guest Julian Brigden who noted that the US equity weight of new investment flows is 70% of every dollar, a huge pct relative to US GDP/global GDP. I recreated a chart he mentioned, SPX / FEZ ratio, where FEZ is the Eurostoxx etf. As can be seen, it’s testing a long-term trendline. On a related note, Atlanta Fed GDP Now has added a ‘gold-adjusted’ measure. Why? Because US imports of gold were so large that they mechanically depressed GDP. Obviously, recalibrations of capital flows that are already unbalanced can have a huge effect on markets, with little change in economic ‘fundamentals’. Those catch up later….

Bluff

March 30, 2025 – Weekly Comment

**************************************

This might not be the greatest analogy, but it’s a story I enjoyed hearing firsthand, so here it goes. There was a large filling broker in front month Eurodollars. This is, obviously, well before SOFR, and when 1 bp was the minimum tick, not 0.5 bp. It was at a time when the entire strip in futures would trade perhaps 100-250k, not 4 million like Friday’s volume.

At the time, there were no restrictions on dual trading. That is, a broker could be standing in the pit and trading his own position while filling orders for customers. Front-running was still a rule violation, you couldn’t get a big buy order and buy a couple hundred for yourself first, but other than that the rules were easier.

Anyway, this particular broker (not pictured; wasn’t PAT and wasn’t OPA) filled orders for Solomon Bros, and some other large houses. He told me he was short something like 1000 contracts in his personal account on a day that was slowly but unrelentingly bid. So, he offered 3000 contracts in an attempt to turn the tide. The pit generally would think it was a ‘paper’ offer, and at that time, such an order might have even been large enough to draw in some sellers. Open outcry! 3000 at 9… 3000 at 9! He offered for a couple of minutes, trying to hold the market down. Here’s the fun part: one local just looked him in the eyes and said ‘buy ‘em’. Never made eye contact again, just glanced down and impassively carded up the trade. Of course it’s immediately 9 bid, trading 10s. As my friend recounted this tale, he said every bit of air immediately exited his lungs, slumping his shoulders for added emphasis to convey the distress. The bluff (spoof) that didn’t work.

What made me think of this particular story is the NVDA/ CoreWeave entanglement. The IPO for CoreWeave, an AI data-center company backed by its supplier NVDA, occurred Friday. MSFT is CRWV’s largest customer. The IPO initially was supposed to value the company at $27 to $32 billion. On March 19, Reuters reported a planned IPO price of $47 to $55, to raise $2.3 to 2.7b. Every news clip I saw said the offering was oversubscribed. On March 26, FT reported that CRWV had triggered a technical default last year as it used loan proceeds from Blackstone to expand into Europe, when collateral for the loan was specified to be US assets. Blackstone forgave this ‘oversight’. On March 27 CRWV announced plans to cut the IPO size to $1.5b, and the price to $40, and NVDA announced plans to anchor the deal with a $250 million order to buy at $40. All of a sudden it’s as simple as the pit. NVDA’s already long. Now showing a big bid to bluff the market. “Hey Jensen, you’re filled. Want more? It’s 39 offer.” During this time, rumors continued to swirl about MSFT cutting back on AI and data-center investments. One report I read said MSFT cancelled a $12b dollar CRWV order, but Open AI jumped in as savior and took MSFT’s place. ‘Just Dario’ (blogger/podcast) amusingly refers to Open AI as being in “the money incinerator business.”

I am no expert on AI, etc. But I do remember Enron. Not that this is the same, but it might be prudent to stand aside. In a broader sense, US stocks have been supported by AI hype, deregulation, a benign Fed, and hopes that DOGE will correct the govt spending spree. AI seems vulnerable, DOGE might be doing too good of a job. The Fed just EASED with a cutback of QT and SPX is lower in the aftermath. If only there were a signal.

Survey data should be taken with a grain of salt, but U of Michigan’s Consumer Expectations provides backing for Powell’s comments at the press conference: “…we do understand that sentiment has fallen off pretty sharply…”

The chart below shows Expectations in white, oil in blue and SPX in green.

The Index of Consumer Expectations focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term.

There are just a few lower readings in expectations: 2008 at 49.2 and 2009 at 50.5 (GFC). 2011 at 47.6. 2022 is the lowest at 47.3 (Fed hikes, stocks breaking and oil bid). Covid was way up at 65.9. Consumers being squeezed by higher oil prices is a contributing factor to falling confidence. Not this time. Oil’s price is dropping.

I’ve written several times that I think the Fed will ease in May. Met with derision. However, there are two employment reports before the May 7 FOMC, Friday’s and May 2. SPX is down less than 10% from Feb’s all-time high. At the low a couple of weeks ago, Nasdaq Comp was down 11%. What if a slide to minus 20% occurs? Powell has every incentive to cut 25 in a nod to Trump. Of course, if the Fed does cut there will be MASS HYSTERIA claiming the Fed has lost credibility by easing after having raised inflation estimates. The ‘lost credibility’ phrase has been around as long as I have been in the business. We’re going into ‘Liberation Day’. What are we hanging on to?

On a more serious note, the Cleveland Fed and BLS publish a quarterly figure of ‘New-tenant rents’. (Noted by Danielle DiMartino Booth). At the end of Q4 this number was -2.4%. Shelter is 32% of CPI. Next release should be towards the end of April. The report notes: “Sample sizes for the New Tenant Rent Index are much smaller than for the All Tenant Regressed Rent Index or the official CPI; this is especially the case in the first and fourth quarters when fewer moves happen.”

The real concern over a Fed cut will be reflected by a surge in long-end rates. Indeed after the Fed’s ‘no policy implication’ QT ease on March 19, the 30y yield rose about 18 bps to 4.72%. However, this week’s close was 4.63%. I’m sure Bessent would prefer the Fed holding pat. The risk is that falling stocks, whether related to tariffs, a slowing economy, or employment deterioration (all of the above?) overwhelms every other consideration. Chart below of 2/30 is clearly in steepening trend, but actually low by historical standards.

Last week I wrote that the SFRU5/U6/U7 fly was tracking well with the recent move in ESM, but noted that the fly had made a new low while ESM had bounced. This week, another new low in the fly at -48.0 (from -47.0 last week). Stocks gave up the gains (caught down).

It’s not panic if you’re first (paraphrasing from the movie Margin Call).

Ease trades (mentioned last week) SFRK5 9600/9625/9637.5 c fly 1x3x2 settled 2.0. SFRM5 9600/9625/9643.75 c fly settled 2.75.

| 3/21/2025 | 3/28/2025 | chg | ||

| UST 2Y | 392.5 | 390.6 | -1.9 | |

| UST 5Y | 401.4 | 397.9 | -3.5 | |

| UST 10Y | 424.8 | 425.3 | 0.5 | |

| UST 30Y | 459.2 | 463.1 | 3.9 | |

| GERM 2Y | 213.2 | 201.9 | -11.3 | |

| GERM 10Y | 276.5 | 272.7 | -3.8 | |

| JPN 20Y | 226.2 | 224.5 | -1.7 | |

| CHINA 10Y | 185.2 | 181.5 | -3.7 | |

| SOFR M5/M6 | -59.5 | -62.5 | -3.0 | |

| SOFR M6/M7 | 5.0 | 3.0 | -2.0 | |

| SOFR M7/M8 | 14.0 | 15.0 | 1.0 | |

| EUR | 108.22 | 108.28 | 0.06 | |

| CRUDE (CLK5) | 68.28 | 69.36 | 1.08 | |

| SPX | 5667.56 | 5580.94 | -86.62 | -1.5% |

| VIX | 19.28 | 21.65 | 2.37 | |

| MOVE | 94.54 | 96.83 | 2.29 | |

New Curve highs

March 28, 2025

****************

–New highs in many curve measures. For example 2/10 up to 37 bps (+4.5) and 5/30 at 63 (+3.0). 2/10 had printed higher in January at 42.3, but 5/30 has surpassed the high from last September of 61.4 and is highest since the very start of 2022. 2y (new) 3.996%, down 1.2 bps and 10y +3.3 bps to 4.367%.

–SOFR curve steeper as well, with new highs in deferred calendar spreads. For example, SFRM7/SFRM8 one-year spread settled 15.5 (9641.0/9625.5), up 2.0 on the day. These back spreads typically move slowly; on March 3, to start the month, it was 8.0. My interpretation is that term-premium is increasing and/or the market is concerned about forward inflation, and perhaps becoming less confident about Treasury being able to easily sell longer dated debt. Perceptions of a looser Fed going forward is another possible signal.

–Main news today PCE Prices: expected 0.3 with Core also 0.3 m/m. YOY expected 2.5 from 2.5 last, with Core 2.7 from 2.6. Truflation is running at 1.8%.

–Gold made a new ATH yesterday, and current GCJ5 is 3081.10, +20.10 to another new high. Spot silver high last year 34.90, currently 34.41.

–This may have little impact on the market in general, but CoreWeave expected to begin trading today. Interesting in that it’s an AI play, but the valuation has been ratcheted lower, not higher. So, from an earlier estimate of around $30 billion, it’s now $19b and NVDA was compelled to take this step:

“Nvidia will anchor the CoreWeave IPO at the price with a $250 million order [at $40], a person familiar with the matter told Reuters earlier on Thursday.”

X contributors like @JG_Nuke and @DarioCpx have been saying CoreWeave (& NVDA) have been using shady accounting to support valuations. Now we’ll get to see how it plays out in the public markets.

Well, if you adjust it by the price of REAL money…

March 27, 2025

****************

–Yields ended slightly higher, with tens and 30s both up 3 bps to 4.334% and 4.682%. SOFR contracts from Z5 to Z9 down 1.5 to 3 bps. 7-yr auction today.

–While price changes were minor, vol firmed, perhaps a spillover from weak equity prices, with SPX falling 1.1%. VIX slightly higher at 18.52. Early buyer of 80k SFRZ5 9562.5/9537.5ps for 1.75. Top strike 4.375% with EFFR 4.33%. New buyer of 40k SFRM5 9550 for 0.5. That strike is currently 38 bps otm and 17 bps above current EFFR. The 9562.5p also settled 0.5. Of course it could be uncomfortable being short wings for 2 ½ months if the wheels come off the rails. Also a roll of 22k 0QM5 9712.5c into 0QU5 9750c, settled 4.5 in 0QM5 vs 9643.0 in M6 and 5.25 in 0QU5 vs 9645.5 in U6. Extending the time but paying for it with a much higher call strike.

–It feels as if there’s energy building below the surface in rates. However, prices and spreads are muted for the time being. NY Fed released its March Corporate Bond Distress Index, and… nothing to see here:

- Corporate bond market functioning appears healthy. The end-of-month market-level CMDI is unchanged compared with last month and is just below its historical 5th percentile.

–The tendency is always that things look ok, maybe a few small cracks, and then ka-boom. Typically looks obvious in hindsight. Maybe that’s the message of gold, with GCJ5 up $26 this morning over 3048, looking to test recent all-time-highs.

–Final Q4 GDP today. But as we approach the end date of Q1, it’s probably more important to focus on ATL Fed’s GDPNow which is -1.8%. So I pulled up the site:

https://www.atlantafed.org/cqer/research/gdpnow

and had to rub my eyes! Is THIS NEW?? They’ve now added a GOLD-ADJUSTED GDP-NOW!! We’re not in Kansas anymore.

When the hard data confirms

March 26, 2025

****************

–Yields slightly lower Tuesday, retracing a small part of Monday’s rise. Tens down 2.5 bps to 4.304%. FFJ4 settled exactly at the EFFR rate of 4.33%, at 9567.0. One year forward FFJ5 settled 9642.5 or 3.575, three-quarters of a percent lower (8 FOMC meetings in between). New high in 5/30 treasury spread, 60 bps (4.052% & 4.652%). The high of last September was 61.3, intervening low was 25. Current level testing Sept, is the highest since 2021, before the Fed started to hike. Five-yr auction today, followed by 7s tomorrow.

–Early buyer of 60k 0QU5 9550p for 4.5 (ref 9642.5). Settled 3.75 vs 9648.5, nearly 100 bps otm (OI +49k). The 100 bp CALL otm is the 9750 strike, which settled 7.25. The 9550 strike is 4.5%, which is the upper end of the band of the current FF target, 4.25 to 4.5%. The 2.5% strike, the 9750c is nearly 2x as much premium, but the strike is 200 bps away from the current upper band.

–You would have to think the economy is going to take a cliff-dive to buy the 9750 strike, right? Well, today’s Consumer Confidence number was the lowest in four years at 92.9. Philly Fed Services at -32.5, lowest in 5 years (covid). From a CNBC survey:

The economy will enter a recession in the second half of 2025, according to a majority of chief financial officers responding to the quarterly CNBC CFO Council Survey.

https://www.cnbc.com/2025/03/25/recession-is-coming-pessimistic-corporate-cfos-say-cnbc-survey.html

And from FT: Moody’s warns on deteriorating outlook for US public finances

–Will the hard data lag in confirming? Below are Powell’s comments relating to sentiment, at the last press conference, highlights added:

But the second factor is, it’s so highly uncertain, is just, you know, we’re sitting here thinking, and we obviously are in touch with businesses and households all over the country. We have an extraordinary network of contacts that come in through the reserve banks and put it in the Beige Book, and also through contacts at the Board. And we get all that, and we do understand that sentiment has fallen off pretty sharply, but economic activity has not yet. And so we’re watching carefully, so I would tell people that the economy seems to be, seems to be healthy. We understand that sentiment is quite negative at this time, and that probably has to do with, you know, turmoil at the beginning of an administration. It’s making, you know, big changes in areas of policy. And that’s probably part of it. I do think the underlying unhappiness people have about the economy though is more, is more about the price level. [rather than actual current inflation]