Pitchforks and Torches

March 22, 2024

****************

–April treasury option expiration today.

–Rates showed little net change, weakest SOFR contract was SFRM5, closing -3.5 at 9596.0. Tens were about unchanged at 4.269 while twos rose 3.2 bps to 4.63%.

–A couple of large new trades:

In TY Week2 (April 12 expiry)

+50k 110.75c 0’42 covered 110-23, 50d

+50k 110.50p 0’42 covered 110-18, 46d

Strangle 1’20, settled 1’14 vs 11012+ Call 0’32 and put 0’46

+41k SFRM5 9637.5/9587.5/9537.5 p fly 10.0 to 10.5. Settled 10.25 vs 9596.0. Vol lower across the SOFR curve.

–One week from today, 3/29 the CME is closed for Good Friday. PCE prices are being released, and Powell is scheduled to speak at a moderated discussion at the San Fran Fed.

Other events prior to the week2 Treasury expiration:

Next week auctions of 2/5/7 year notes

4/1 ISM

4/3 ISM Services

4/5 NFP

4/10 CPI and Fed Minutes

*********************

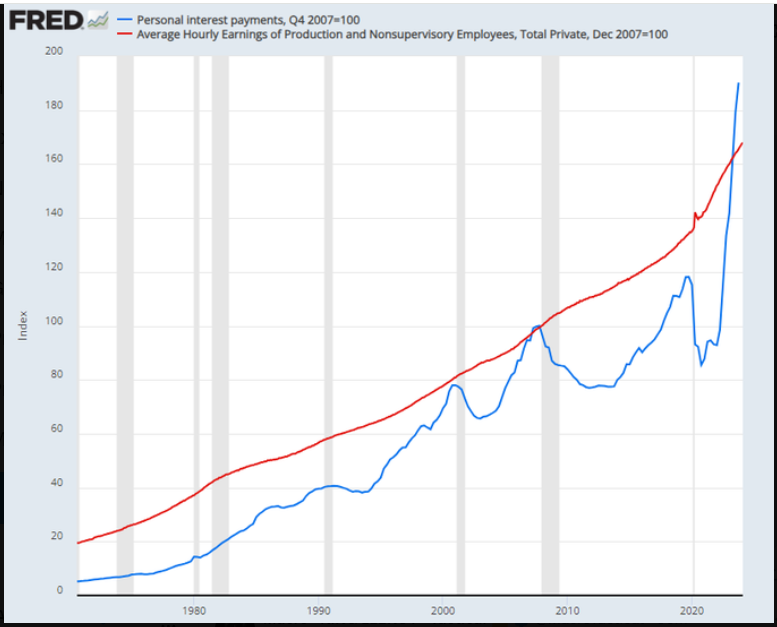

Chart on X, posted by Samantha LaDuc

All I can see when looking at the below chart is this:

Pitchforks and Torches

I am not 100% sure I am interpreting the data correctly; it looks like Personal Interest Payments are exceeding wage income.

However, the Y-axis is an ‘Index’. Not at all surprising that the growth of interest payments is exceeding wages. Everything is.

https://twitter.com/SamanthaLaDuc/status/1770791896559800526