The Occasional Customer

May 5, 2024 – Weekly Comment

**********************************

SBUX – a canary?

SLOOS – Will be released on Monday. Gained prominence one year ago as Powell mentioned at May 3, 2023 press conference

Large decline oil – CLM4 down 5.74 on the week to 78.11

Treasury Auctions of 3s, 10s, 30s

Gov’t tax revenues – when yoy pct change is where it is now, we’re in recession

A couple of bullet points this weekend.

First, the change in trend, or in narrative, tends to happen at the margin. Then it either fizzles or gains traction, culminating in the tipping point. The 2006/07 subprime mortgage crisis was that way; in the beginning it was dismissively referred to as “…a mile wide and an inch deep”. Obviously that one snowballed.

On Thursday May 2, Starbucks CEO Laxman Narasimhan was interviewed by Jim Cramer. The stock was crushed during the interview as Cramer hammered away on lack of strategy. On a macro level, the most interesting excuse for unsatisfactory results was “…unexpected pressures on our occasional customers – more intense than we expected.” Cramer pounded away, saying he had checked with other public and private companies in similar businesses and none of them experienced negative same store sales, capping with this zinger, “Is it possible that your coffee is just too darn expensive?” LN response, “… if I look at the US occasional customer, they have clearly cut back on visits to us.” SBUX is a global company, but it seems to be a US problem.

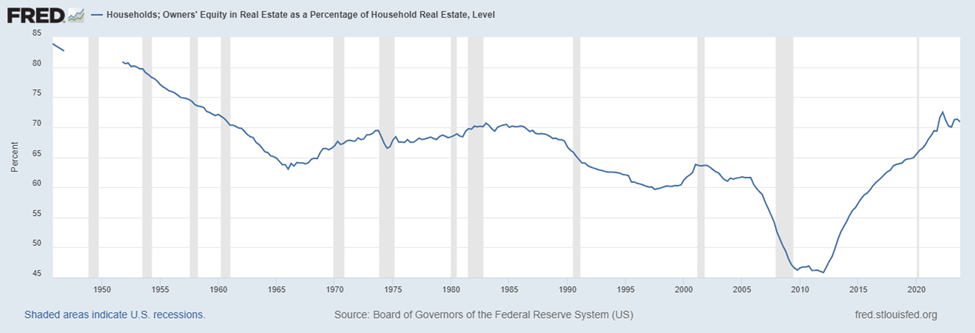

Company specific, or beginning to permeate the economy? That’s the question. The ‘occasional customer’ is the marginal consumer. Last week’s consumer confidence at 97.0 was the lowest since covid, save for one print in 2022 at 95.3. ISM Mfg printed back below 50 at 49.2, but prices paid hit 60.9, highest in nearly two years. Payrolls and ISM Services both lower than expected. Obviously, the CORE US consumer is doing well, according to the numbers. Savers are getting great rates, and Household’s percent of equity in residential real estate, though off last year’s high, is currently 70.9%, which is above every level since 1960. Stocks are bid. Yay boomers. The MARGINAL consumer is getting hammered.

HH Owners Equity as Pct of HH Real Estate

SLOOS on Monday

SLOOS is the Senior Loan Officer Survey which gives an indication of credit tightness. One year ago Powell mentioned SLOOS at the May 3, 2023 press conference, as credit conditions were becoming more stringent (actual report was May 8). I believe SLOOS is released at 2 pm EST on Monday.

A BBG article over the weekend cites CRED iQ noting “Distress in CRE CLO loans jumps back up to record 8.6% in April.” Link at bottom.

CLM4 down $5.74 on the week

CLM4 ended the week at 78.11, right around the midpoint of the past three qtrs (active contract).

FEDL GOV’T TAX RECEIPTS, PCT CHANGE FROM YEAR AGO

This is an ominous chart. Any time it’s at this level, -7.5% in Q4 2023, we’re in recession. Treasury’s recent borrowing estimates indicated a shortfall in tax revenues. In Q1 2008 as this data slipped into negative territory, SPX was down about 38% three quarters later. In Q1 2001, SPX was about even three quarters later, but the trend was down.

Treasury auctions $58b 3s on Tuesday, $42b 10s on Wednesday and $25b 30s on Thursday.

Last week I noted “Demand for insurance continues to be weighted toward lower rates ensuing from an economic or financial ‘accident’.” The relief rally following FOMC and weak payrolls saw SFRU5 as the star contract, up 28.5 bps to 9579.0 or 4.21%. In treasuries 5s were the star, down 21.3 bps to 4.478%. Thirties fell just 12.2 bps to 4.66%. Implied vol was significantly lower to end the week (in front of limited economic data this week).

| 4/26/2024 | 5/3/2024 | chg | ||

| UST 2Y | 499.8 | 480.1 | -19.7 | |

| UST 5Y | 469.1 | 447.8 | -21.3 | |

| UST 10Y | 466.9 | 449.5 | -17.4 | wi 448.7 |

| UST 30Y | 478.1 | 465.9 | -12.2 | wi 465.7 |

| GERM 2Y | 298.8 | 292.4 | -6.4 | |

| GERM 10Y | 257.5 | 249.5 | -8.0 | |

| JPN 20Y | 165.0 | 168.3 | 3.3 | |

| CHINA 10Y | 230.6 | 231.5 | 0.9 | |

| SOFR M4/M5 | -64.0 | -90.5 | -26.5 | |

| SOFR M5/M6 | -41.5 | -39.5 | 2.0 | |

| SOFR M6/M7 | -12.5 | -9.0 | 3.5 | |

| EUR | 106.93 | 107.64 | 0.71 | |

| CRUDE (CLM4) | 83.85 | 78.11 | -5.74 | |

| SPX | 5099.96 | 5127.79 | 27.83 | 0.5% |

| VIX | 15.03 | 13.49 | -1.54 | |

https://twitter.com/JaguarAnalytics/status/1785905153054224854

https://blinks.bloomberg.com/news/stories/SCUYN7T1UM0W