Yields and Vol down

May 6, 2024

*************

–Weaker than expected employment report at 175k sparked a rally in rate futures. SFRM5 and U5 were strongest on the strip at +12 (9562 and 9579). Current EFFR is 5.33% and SFRM5 is 4.38%, still nearly 100 lower. Ten year yield fell 7.2 bps to 4.495% in front of treasury auctions starting tomorrow, 3s, 10s, 30s. ISM Services also weak at 49.4.

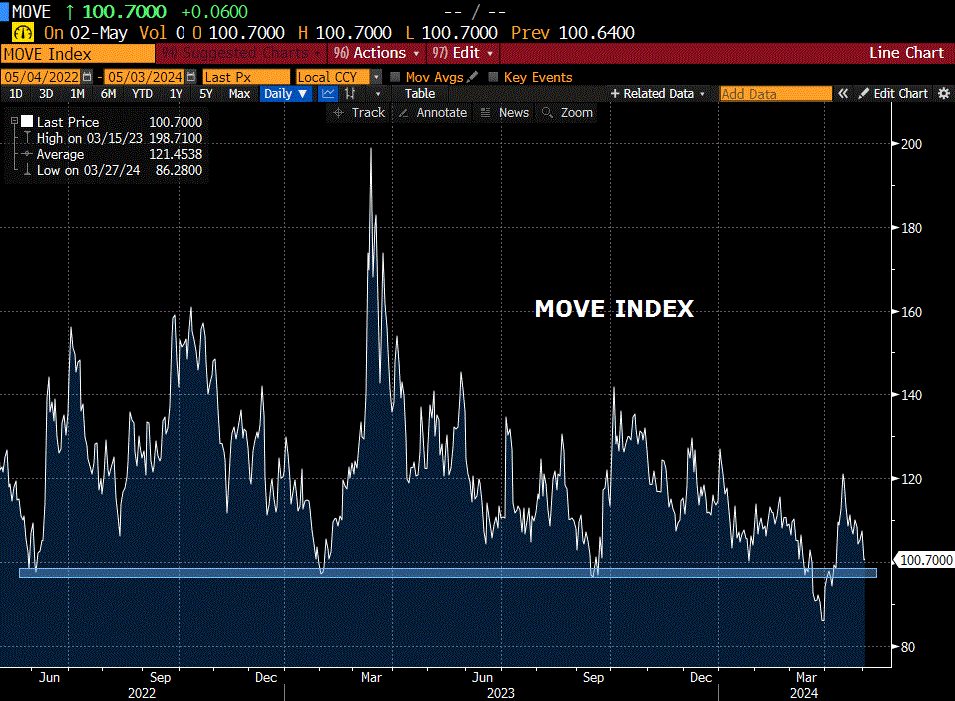

–With the fall in yields came a fall in implied vol. As the attached MOVE chart shows, we’re now approaching an area of hiking-cycle support. Today Barkin and Williams speak. SLOOS (Sr Loan Officer Opinion Survey) is this afternoon. Could be important as Powell had specifically cited it one year ago at the May 2023 FOMC.

–With May SOFR midcurves expiring Friday, 0QK4 9562.5 straddle settled 14 vs 9562.0. On Thursday the pre-NFP atm straddle was 19. Not a lot of economic data this week; 14 still likely a bit on the high side.