Free Loans at Risk

May 15, 2023

–Selling pressure across rate futures on Friday, led by weakness in the front end. SFRZ3 settled 9567.5 (-10) or 4.325%. The red pack settled 9698.0 or 3.02%. down just over 12 on the day. The 2y note ended at 3.99%, up 8.7 bps on the day, tens +6 at 3.455%. Vol softened considerably in SOFR. For example, SFRU3 9525^ settled 63.0, one week ago the atm 9531.25^ was 74.0. On Friday SFRU3 option trading favored the upside. Buyer of about 15k each SFRN3 and U3 9525/9575/9625 c flies, settled 4.0 and 3.0 ref 9522.5. Seller of 20k SFRU3 9506.25/9493.75/9481.25 put tree for credit of 0.75 to 0.5 (buying top strike for credit; settled -0.25).

–Retail Sales tomorrow. Several articles note that credit card spending is slowing.

–According to @FreightAlley, ever since COVID, “$1.12 trillion of student leans remain in forbearance… On July 1, 2023, the student loan forbearance program ends and payments will resume.” This deferral has been repeatedly extended by the Biden administration, but there is apparently a suit that questions the legality of using the HEROES act to extend non-payment.

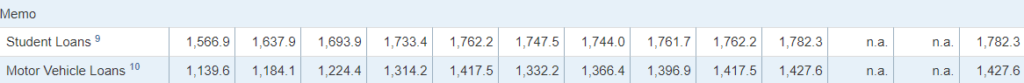

–Total student loans are over $1.7 trillion with most of that owed to the federal government. If the interest rate is 5% and the amount in forbearance is $1 trillion, then that’s a subsidy of $50 billion/yr. The attached link claims $5 billion per month. That’s a lot of Starbucks lattes. I view this as a direct withdrawal from Consumer spending (if it occurs). It’s not as if gov’t spending goes up due to the windfall, gov’t spending will continue at its same unsustainable pace. Also, it’s likely the case that a large chunk of those loans will never be paid. But if the deferral ends, it’s another factor likely to restrain consumer spending.

$1.12 trillion worth of student loans remain in forbearance, meaning that payments have been temporarily paused. On July 1, 2023, the student loan forbearance program ends & payments will resume.

4.99%

If you got your Direct Subsidized or Unsubsidized Loan on or after July 1, 2022, and before July 1, 2023, it will have a fixed interest rate after the payment pause ends: For undergraduate students, the interest rate for Direct Subsidized Loans and Direct Unsubsidized Loans is 4.99%.